Ten Issues of Revista do IBEDAFT – 2020-2025 (Brasil)

🌎 The Brazilian Institute of Studies on Administrative, Budgetary and Tax Law (IBEDAFT) has recently published the 10th issue of its prestigious Revista do IBEDAFT. This publication features articles on a variety of public policy issues and has been a staple of Brazilian legal studies for the last six years. ❤️ Consider supporting our mission and […]

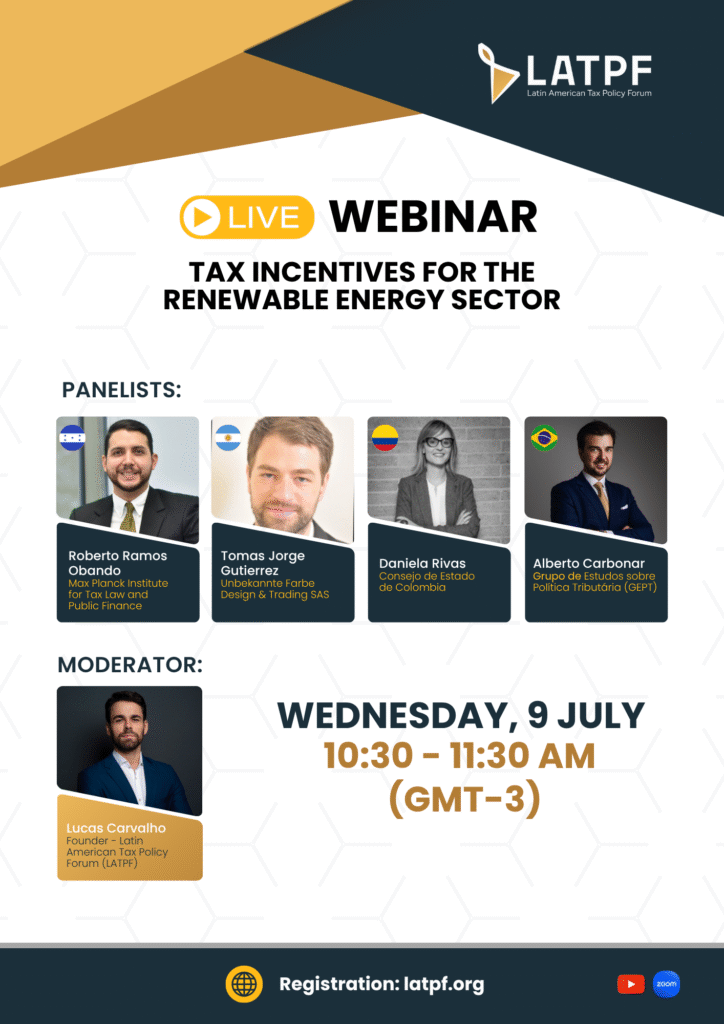

LATPF Webinar: “Tax Incentives for the Renewable Energy Sector”

🌎 We’re thrilled to announce the FIRST webinar of the Latin American Tax Policy Forum (LATPF) – now open for registration (https://bit.ly/4nskxwa)! 🗓 When: Wednesday, July 9th | 10:30-11:30 AM (GMT-3) 🗣 Language: English 💻 Where: Live on Zoom (FREE for all) and broadcast on our channel on YouTube (https://bit.ly/45SHD8Z) 📌 The topic of this […]

Transfer Pricing and Football: Impacts on the Cross-border Sale or Lease of Football Players

Davi Santana de Jesus is a Transfer Pricing partner at CONSULTA Group. He is based in São Paulo (SP), Brazil. As the opening whistle of the FIFA Club World Cup approaches, a new dynamic in Brazilian football becomes increasingly evident: the rise of Football Corporations (SAFs – Sociedades Anônimas do Futebol). Mostly controlled by international […]

New Issue of Revista de Derecho Fiscal (Colombia)

🌎 Universidad Externado de Colombia has recently published a new issue of its prestigious Revista de Derecho Fiscal. This issue features eight articles written about topics ranging from tax arbitration to cryptoassets and money laundering. ❤️ Consider supporting our mission and joining the LATPF Community as a member (https://latpf.org/membership/). Here is the list of this […]

New Issue of Revista Direito Tributário Internacional Atual (Brasil)

🌎 This month, the Brazilian Institute of Tax Law (IBDT – Instituto Brasileiro de Direito Tributário) published a new issue of its prestigious Revista de Direito Tributário Internacional Atual. This issue features articles on current topics of international taxation written by prominent experts (from Brazil and other countries). The editors of this journal are Leonardo […]

Diálogos – Revista Electrónica de Fiscalidade

🌎 Part of the mission of the Latin American Tax Policy Forum (LATPF) is to facilitate dialogue on tax policy issues that are relevant to LatAm practitioners. We do that by publishing monthly reports about LatAm tax policy, curating recommendations of more than 2,500 articles from 80+ journals for the members of our Community (❤️ […]

Diálogos – Rivista Telematica di Diritto Tributario

🌎 Part of the mission of the Latin American Tax Policy Forum (LATPF) is to facilitate dialogue on tax policy issues that are relevant to LatAm practitioners. We do that by publishing monthly reports about LatAm tax policy, curating recommendations of more than 2,500 articles from 80+ journals for the members of our Community (❤️ […]

Diálogos – Revista Jurídica (Pérez-Llorca) and LatAm articles

🌎 Part of the mission of the Latin American Tax Policy Forum (LATPF) is to facilitate dialogue on tax policy issues that are relevant to LatAm practitioners. We do that by publishing monthly reports about LatAm tax policy, curating recommendations of more than 2,500 articles from 80+ journals for the members of our Community (❤️ […]

New Issue of Revista de Direito Tributário da APET (Brasil)

🌎 APET – Cursos Tributários has recently published a new issue of its prestigious Revista de Direito Tributário da APET. This is a journal centered on themes of Tax Law and Policy. It features articles written by some of the most prominent tax experts in Brazil and it is coordinated by Marcelo Magalhaes Peixoto, Diógenes […]

New Issue of Revista Direito Tributário Atual (Brasil)

🌎 Edited by Fabiana Carsoni Fernandes and Fernando Zilveti and published by IBDT – Instituto Brasileiro de Direito Tributário, the Revista Direito Tributário Atual (Current Issues of Tax Law Review) is one of the most prestigious publications in Tax Law and Policy in Brazil. This issue features 32 articles written by prominent experts about topics […]

New Issue of Revista de Direito Contábil Fiscal (Brasil)

🌎 APET – Cursos Tributários has recently published a new issue of its prestigious Revista de Direito Contábil Fiscal. This is a journal centered on themes that connect Tax Law and Policy with Accounting. It features articles written by some of the most prominent tax and accounting experts in Brazil and it is coordinated by […]

New Issue of Revista de Tributación of AAEF (Argentina)

🌎 Earlier this year, the Argentine Association of Fiscal Studies (Asociación Argentina de Estudios Fiscales – AAEF) published a new issue of its prestigious journal, Revista de Tributación. It features six articles written by prominent experts about themes ranging from VAT to international tax hubs. ❤️ Consider supporting our mission and joining the LATPF Community as […]

New Issue of Revista ICDT (Colombia)

🌎 The Colombian Institute of Tax and Customs Law (ICDT Instituto Colombiano de Derecho Tributario) has published a new issue of its prestigious Revista ICDT. Issue 90 is themed around the taxation of contracts or vehicles without legal personhood. ❤️ Consider supporting our mission and joining the LATPF Community as a member here (https://latpf.org/membership/). Here is […]

New Issue of Revista Tributária e de Finanças Públicas (Brasil)

🌎 The Brazilian Academy of Tax Law (ABDT), presided by Marcelo Campos, has recently published a new issue of its prestigious Revista Tributária e de Finanças Públicas. This issue features articles written by prominent experts and researchers about domestic, regional and multinational tax policy themes. ❤️ Consider supporting our mission and joining the LATPF Community […]

New Issue of Revista Debates de Derecho Tributario y Financiero (Argentina)

🌎 Last week, the School of Law of Universidad de Buenos Aires in Argentina released Issue 15 of its prestigious Revista Debates de Derecho Tributario y Financiero. The theme of this issue is “Administrative, Budgetary and Tax Procedure”. ➡️ Here is the list of articles featured in this issue. As usual, the Latin American Tax […]

New Issue of Revista de Estudos Institucionais (Brasil)

🌎 The Faculdade Nacional de Direito FND – UFRJ has just published Volume 11, Number 2, of its prestigious Revista de Estudos Institucionais (Journal of Institutional Studies). The “Dossier” section of this issue features 10 articles about Tax Law and Policy written by prominent academics and students in Brazil. ➡️ Here is the list of […]

New Issue of Economía & Negocios (UNJBG – Peru)

🌎 Last week, Universidad Nacional Jorge Basadre Grohmann in Peru released Issue 7(1) of its prestigious journal Economía & Negocios. This is not a tax publication per se, but some of its issues feature articles discussing field research in taxation. 💡 This is a list of the tax-related articles published in three issues of Economía […]

New issue of Revista de Direito Tributário e Financeiro (CONPEDI – Brazil)

🌎 Back in March, Conpedi – Conselho Nacional De Pesquisa E Pos-Graducao Em Direito published a new issue of its prestigious Revista de Direito Tributário e Financeiro. It contains five articles written by a mix of young researchers and seasoned practitioners and scholars in Brazil. ➡️ Here is the list of articles featured in this […]

First Issue of the Yearbook of the Specialization in Tax Law of UCV (Venezuela)

📚 The Facultad de Ciencias Jurídicas y Políticas de la Universidad Central de Venezuela (Universidad Central de Venezuela) has recently published the first issue of their prestigious Yearbook of the Specialization in Tax Law. Members of the Yearbook’s Editorial Board include Serviliano Abache Carvajal, Rosa Caballero, David Mongiovi and Silvana R. Tineo. 💡 The Yearbook […]

Diálogos – Crónica Tributaria and LatAm articles

🌎 “Diálogos” is a series of posts produced by the Latin American Tax Policy Forum (LATPF) that recommend free articles from recognized publications + articles on similar topics written by LatAm authors. The purpose of this series is to facilitate the exchange of tax policy ideas that can be relevant for Latin America as a […]

Diálogos – Tax Adviser and LatAm articles

🌎 “Diálogos” is a series of posts produced by the Latin American Tax Policy Forum (LATPF) that recommend free articles from recognized publications + articles on similar topics written by LatAm authors. The purpose of this series is to facilitate the exchange of tax policy ideas that can be relevant for Latin America as a […]

Special Issue of Cadernos Jurídicos (Tax Law – Brazil)

🌎 The São Paulo School of Judges of Tribunal de Justiça de São Paulo has recently published Issue 67 of its well-known journal titled “Cadernos Jurídicos”. Though not a tax journal per se, this issue of Cadernos Jurídicos is themed around Tax Law. 📚 Here is the list of the scholarly articles featured in this […]

New Issue of Revista Debates (Argentina)

🌎 The Facultad de Derecho, Universidad de Buenos Aires (Universidad de Buenos Aires) has recently published Issue 14 of its prestigious Revista Debates. This issue is themed around the 30-year anniversary of the GATT of 1994 (World Trade Organization) and it features no less than 14 articles about customs and foreign trade law. 📚 Here […]

Diálogos: Tax Notes and LatAm articles

🌎 Part of the mission of the Latin American Tax Policy Forum (LATPF) is to facilitate the exchange of ideas about tax policy – both from and for the benefit of LatAm. 🔃 “Diálogos” is our new series of posts that recommend free articles from recognized publications + articles from LatAm authors or published in […]

New Issue of Anuario de Derecho Tributario (UDP – Chile)

📚 The School of Law of Universidad Diego Portales has recently published Issue 16 of their prestigious Yearbook of Tax Law (Anuario de Derecho Tributario). This publication is directed by Arturo Selman Nahum and its Editorial Board is composed by Francisco Ossandón Cerda, Maria Paz Plaza Vallejos and Agustín Díaz Vicente. 💡 Here is the […]

Event: Actualidad Tributaria em Latinoamérica (Univ. Concepción)

🖥️ On March 28, from 9:00AM to 1:00PM (GMT-3), the Facultad de Ciencias Jurídicas y Sociales UdeC (Universidad de Concepción) will host a webinar titled “Actualidad Tributaria en Latinoamérica”. Panelists include Diego Tognazzolo, Gabriela Haro Hermoza, Isabella Bello Hurtado, BALTAZAR MAROTTE and Ignacio Rodriguez. ➡️ You can register for the event by using the QR […]

Three Issues of Tributos y Aduanas (SUNAT)

🌎 The Peruvian National Superintendency of Customs and Tax Administration (SUNAT) has recently released Issue 3 of its prestigious Revista Tributos y Aduanas. Considering its three Issues, 16 articles from authors in LatAm and abroad have been featured in Tributos y Aduanas between 2022 and 2025. 📚 Here is the list of those 16 articles, […]

First Issue of Revista Debates Interuniversitarios (Argentina)

🌎 The School of Law of Universidad de Buenos Aires (in cooperation with Universidad de Salamanca and The New School) has just released the first issue of their brand new Revista Debates Interuniversitarios. This issue is centered on the topic of “Digital Power, Justice and Rights” and it features an entire Section 3 dedicated to […]

Commentary on PCT’s “Tax Incentives Principles”

📚 Back in January, the Latin American Tax Policy Forum (LATPF) submitted its Commentary to the Public Consultation Draft released by the Platform for Collaboration on Tax (PCT) titled “Tax Incentives Principles”. The PCT is a joint effort launched in April 2016 by the International Monetary Fund, the OECD – OCDE, the United Nations and The […]

New Issue of Forseti – Revista de Derecho (Tax Law, Customs Law and Foreign Trade)

📚 DERUP, a student association of Universidad del Pacífico (PE), has recently published a new issue of their prestigious law journal “Forseti” (Forseti – Revista de Derecho). Issue 21 of Volume 14 of Forseti is centered around “Tax Law, Customs Law and Foreign Trade” and it features articles written by prominent tax and customs experts […]

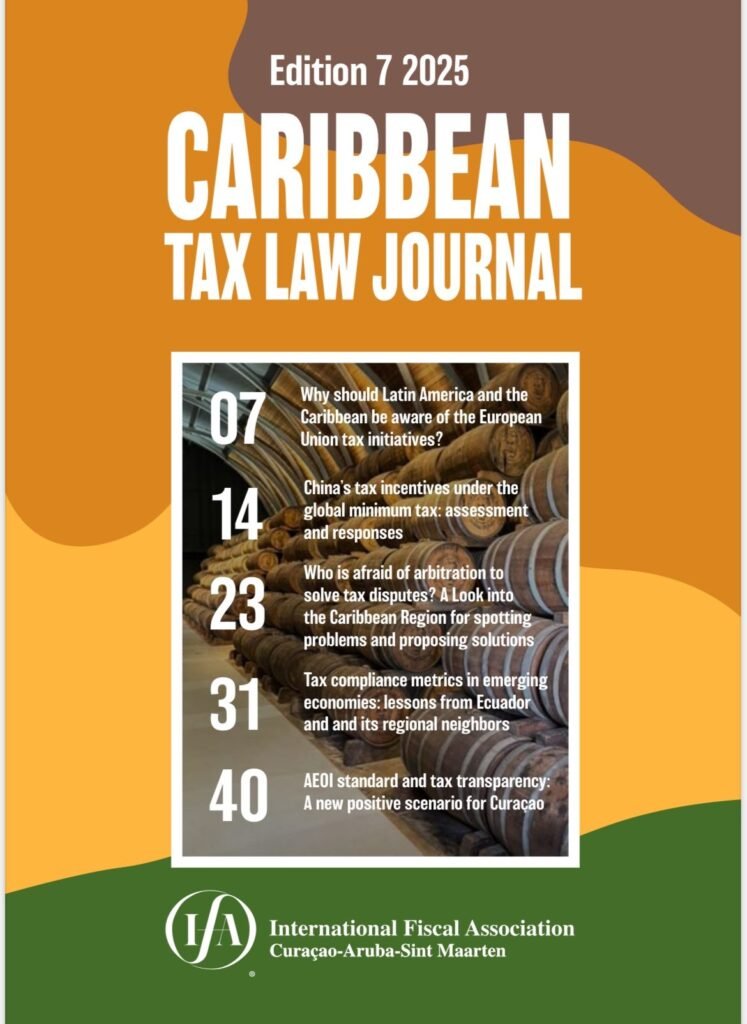

New Issue of the Caribbean Tax Law Journal

📚 IFA Branch Curaçao-Aruba-Sint Maarten has just released Edition 7 of their prestigious Caribbean Tax Law Journal (https://bit.ly/41A4HGX). The journal is edited by Leopoldo Parada – other members of the Editing team include Germaine Rekwest, Shu-Chien (Jennifer) Chen and Hans Ruiter. 💡 Here is the list of articles in this Edition of the Caribbean Tax […]

New Issue of Revista Tributária e de Finanças Públicas (Brasil)

📚 The Academia Brasileira De Direito Tributário (ABDT) has recently published a new issue of its prestigious journal, Revista Tributária e de Finanças Públicas. The journal is coordinated by ABDT’s President Marcelo Campos and features several articles written in Portuguese by prominent tax experts in Brazil. ✏️ Here is the list of the articles in […]

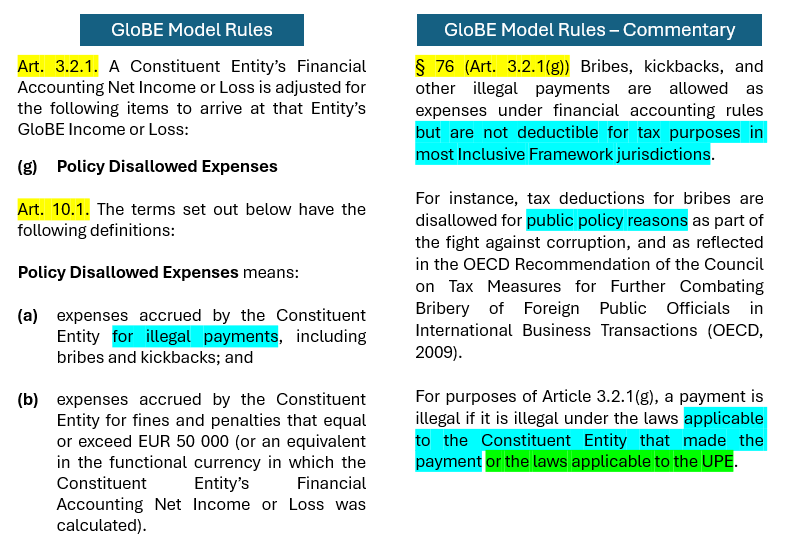

Deductibility of bribes under GloBE rules

🌎 What if the non-deductibility of illegal payments for GloBE purposes violates the definition of taxable income in an implementing jurisdiction? 💵 This is one of a long list of policy choices that were made by representatives of Inclusive Framework jurisdictions in the GMR. However unlikely, if an illegal payment is accounted for in the […]

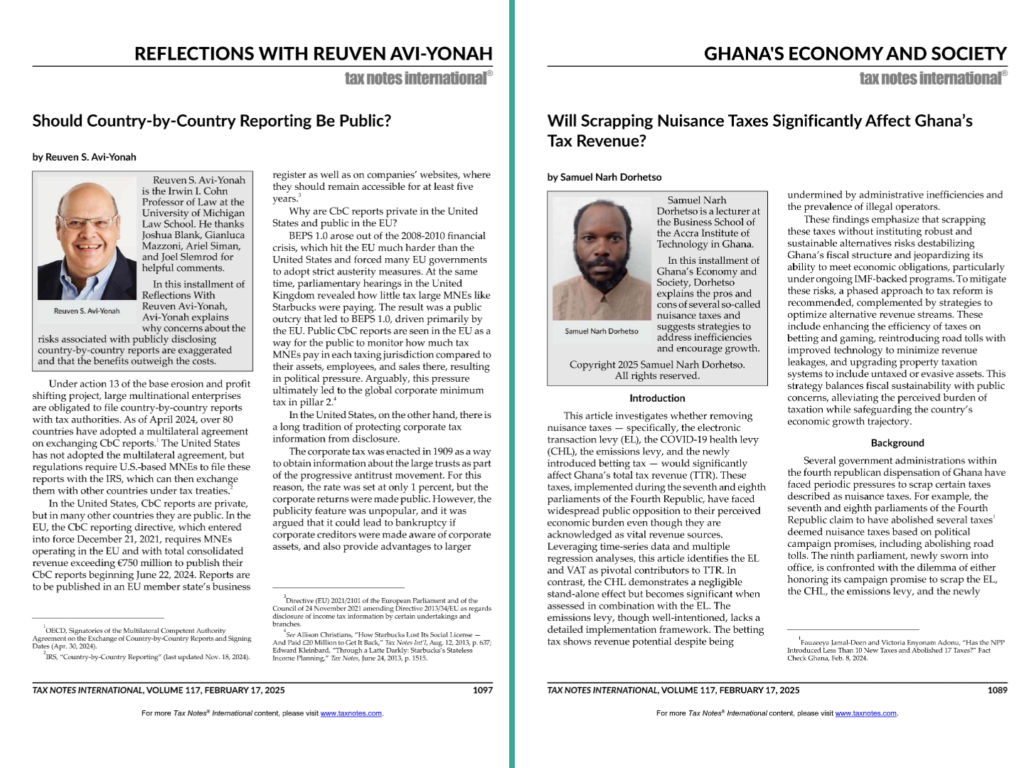

Recommended Articles: Tax Notes International

🌎 ¿Debería hacerse pública la documentación del CbCR? ¿Y cuáles son los pros y los contras de eliminar los “impuestos molestos” (“nuisance taxes”) para la sostenibilidad presupuestaria de los países en desarrollo? 🪟 Dos artículos publicados este lunes por Tax Notes en Tax Notes International podrían ser de especial interés para los policymakers en LatAm. […]

New Issue of Revista Análisis Tributario (AIT – Bolivia)

🌎 The Bolivian Tax Authority (“Autoridad de Impugnación Tributaria” of Estado Plurinacional de Bolivia) has recently published Issue 7 of Year 7 (2024) of their prestigious Revista Análisis Tributario. This issue features articles written and discussed in the XVI Jornadas Bolivianas de Derecho Tributario in Cochabamba, on October 24 and 25, 2024. 📚 Here is […]

Recommended Articles: Tax Notes International

📚 Dos artículos publicados este lunes en la revista Tax Notes International abordan temas de interés para los estudiosos de temas de política tributaria en América Latina. Ellos son: 🚢 En el artículo titulado “Taxation of Demurrage and Detention Damages” (https://bit.ly/40ysjtK), Karl Berlin aborda las tarifas de demurrage (sobrestadía) y detención cobradas en el ámbito […]

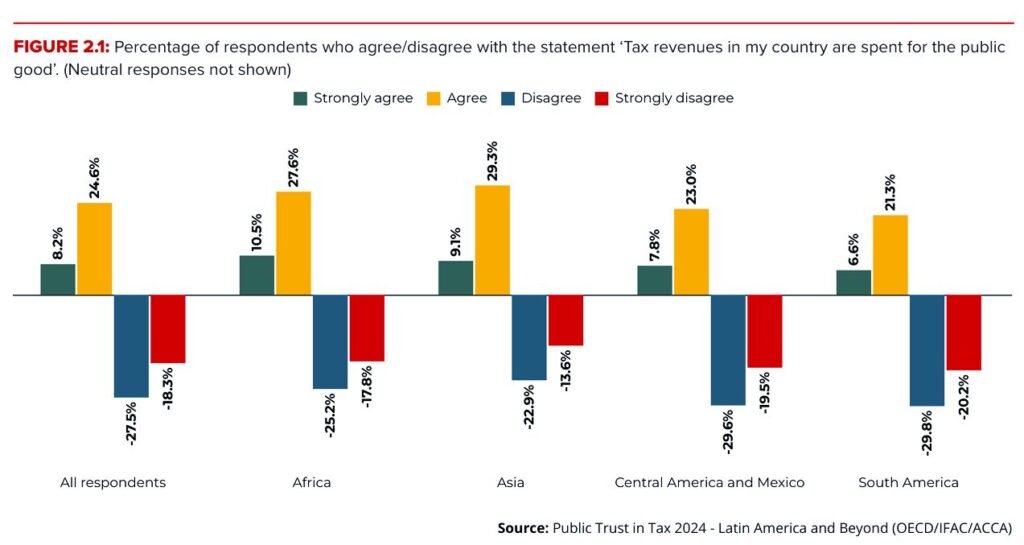

The OECD Public Trust in Tax 2024: Latin America

🐴 “Trust arrives on foot and leaves on horseback.” (THORBECKE, Johan) This is an image taken from a report titled “Public Trust in Tax 2024” (https://bit.ly/4aF7b9Z). It was produced by the OECD – OCDE in cooperation with IFAC and ACCA and it contains insights on public perceptions about taxation, as well as public trust in […]

New Issue of Revista de Direitos Fundamentais e Tributação (Fundação Fênix – Brazil)

🌎 Last year, the Brazilian Fundação Fênix published two Issues of their prestigious Revista de Direitos Fundamentais e Tributação (Journal of Fundamental Rights and Taxation). Some of the most prominent tax experts in the country and abroad have written articles for Issues 1 and 2 of this journal’s Volume 7. Its Editor is Paulo Caliendo […]

Due Process in Latin American courts

⚖️ What due process standards do LatAm courts follow when deciding tax matters? 🟡🔵 In a ruling dated December 12, 2024, the Colombian Administrative Tax Court (Consejo de Estado de Colombia) reversed a lower-tier decision that: 1️⃣ Had stated that the local tax authority (DIAN Dirección de Impuestos y Aduanas Nacionales) failed to provide a […]

New Issue of Revista ICDT (ICDT – Colombia)

📚 The Colombian Institute of Tax and Customs Law (ICDT Instituto Colombiano de Derecho Tributario) has recently released Issue 89 of its prestigious Revista ICDT. With Andrés Felipe Velásquez as its Director and Camila González Henríquez as its Editor, this issue revolves around the – very timely – theme of tax litigation. Here is the […]

Taxation of Stock Options in LatAm courts

🌎 How have LatAm courts ruled on the taxation of stock options (or similar equity-based incentives) in recent cases? 🔴⚪ In a ruling issued on February 9th, 2024, and shared by Roberto E. Polo Ch. earlier this week (https://bit.ly/3DVdlq0), the Peruvian Tax Court (Tribunal Fiscal del Ministerio de Economía y Finanzas del Perú) stated that […]

The Boomerang Order of the Pillar 2 IIR in Brazil

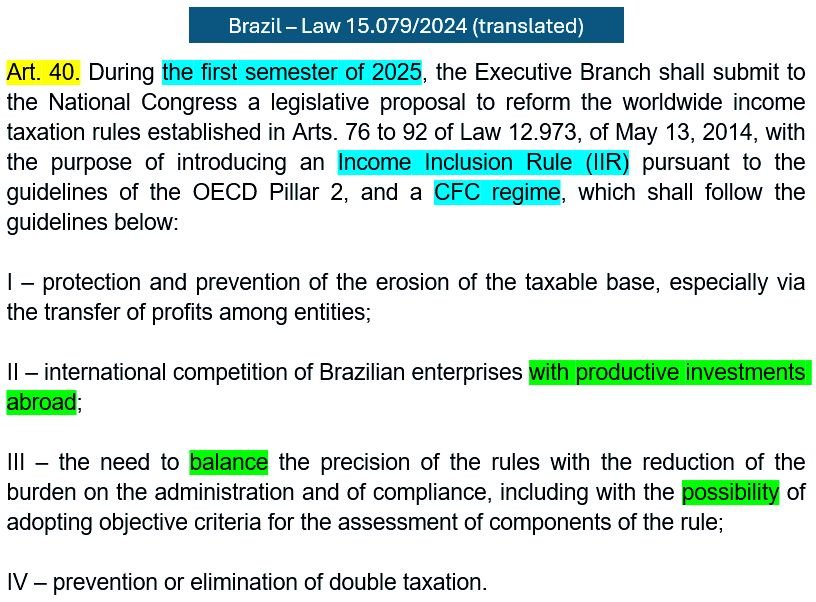

🪃 One of the more intriguing provisions of the law that implemented the QDMTT in Brazil – Law 15.079/2024 (https://bit.ly/4h5Sv5r) – is in its Art. 40. It is a strange article even outside of Tax Law because it is sort of a “boomerang” order: Congress is ordering the Executive Branch to submit a two-pronged bill […]

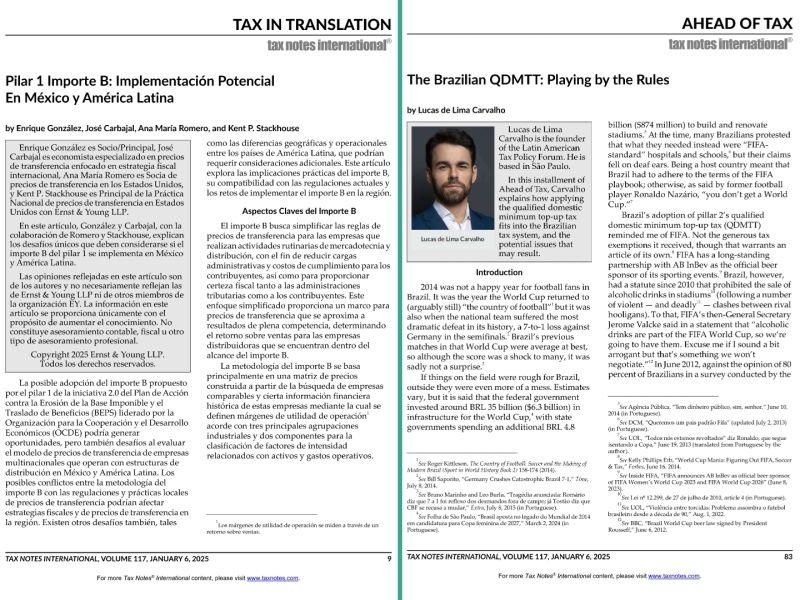

Recommended Articles: Tax Notes International

📚 Hoy, la revista Tax Notes International publicó dos artículos muy interesantes sobre el impacto de los Pilares 1 y 2 del Programa de Trabajo de la OECD – OCDE en los países de LatAm. ¡Y uno de los artículos es bilingüe! 💡 El primer artículo es también la portada de esta edición. El artículo […]

AI in court rulings

🤖 How far should courts go in using AI to draft their rulings? This is a question that has appeared in many recent scholarly articles and is bound to appear again in 2025. Scholars from different parts of the world have expressed their concern with the opacity of AI and its implications for due process. […]

Recommended Article: Argentina’s RIGI

🌎 Can Argentina’s RIGI coexist with the OECD – OCDE GloBE rules? And if it can, would a transparent entity using RIGI qualify as a “resident” under Argentina’s tax treaties specifically because of the GloBE rules applied elsewhere? 📚 Tax Notes has published two very interesting articles in Tax Notes International this week. Though not […]

New Issue of Revista de Derecho Tributario (Univ. Concepción – Chile)

📚 Universidad de Concepción has just published Volume 16 of its prestigious Revista de Derecho Tributario (Tax Law Review). Members of its Editorial Board include Sandra Benedetto, Rocío Cantuarias, César García Novoa, Marcelo Andrés Laport González, Patricio Masbernat, Jorge Montecinos Araya, Loreto Pelegrí Haro, Soledad Recabarren, Mario Rojas Sepúlveda, Francisco Selamé Marchant and Gonzalo Vergara. […]

New Issue of Revista de Direito Tributário Atual (IBDT – Brazil)

📚 On December 15, IBDT – Instituto Brasileiro de Direito Tributário released issue 58 of their prestigious Revista de Direito Tributário Atual (“Current Issues of Tax Law Review”). In this issue, editors Fabiana Carsoni Fernandes and Fernando Zilveti present a selection of insightful articles on topics ranging from the taxation of financial transactions to the […]

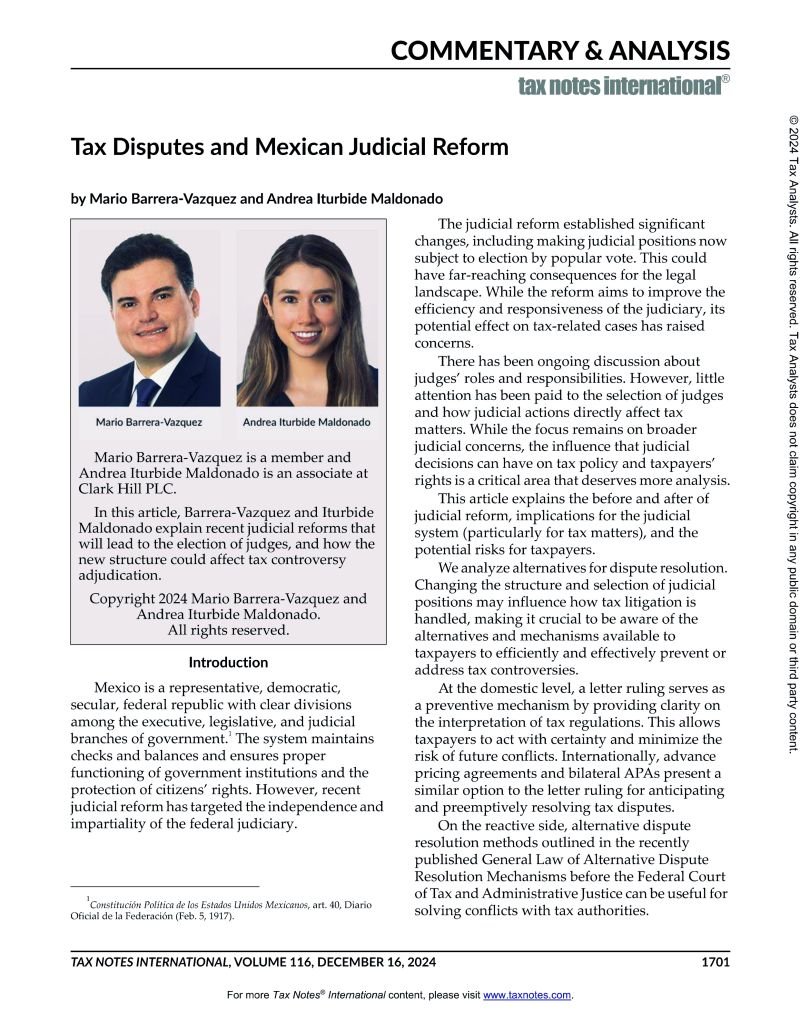

Mexico’s Judicial Reform and its implications for Tax Procedure

🗳️ Mexico is going to hold elections – by popular vote – of around 1,700 judges in 2025 and 2027. The estimated cost of those elections to the public budget is around MXN 13 billion (USD 645 million – https://bit.ly/4feUfs1). In addition, the recently approved judicial reform requires Mexican courts to resolve tax cases in […]

El Límite de la Contabilidad en el Derecho Tributario

✏️ ¿Cuál es el límite de la influencia de la Contabilidad en el Derecho Tributario? La legislación comercial de diferentes países de América Latina establece que las empresas deben registrar y presentar datos de sus operaciones de acuerdo con normas contables como NIIF o IFRS. Esta estandarización cumple el papel fundamental de las Ciencias Contables, […]

New Issue of Revista de Derecho Fiscal (UExternado – Colombia)

🌎 On November 27, the Universidad Externado de Colombia published Number 26 of their prestigious Revista de Derecho Fiscal. This publication features articles from authors across Latin America on subjects ranging from tax litigation to the impacts of taxation in the agricultural sector. Here is a list of the articles of this issue accompanied by […]

Recommended Event: GEPT, Tax Reform and Digital Platforms

🌎 This Friday, the GEPT – Grupo de Estudos sobre Política Tributária (Brazilian Tax Policy Study Group) will host a webinar titled “Reforma Tributária e Plataformas Digitais” (Tax Reform and Digital Platforms). This is a topic that has gained a lot of traction in Brazil since the approval of Constitutional Amendment 132/2023 (which heralded the […]

“Well-established International Standards” in Tax Policy

🌎 What is the definition of “well-established international standards” in tax policy? On November 27, the Minister of Finance of Brazil announced a number of fiscal policy measures that would help the country stabilize public expenditure and correct imbalances in the taxation of income. Individuals earning up to BRL 5,000 per month (~ USD 837) […]

Deductibility of Severance Payments in LatAm courts

💡 Can an employer deduct severance payments from the basis of its corporate income tax (CIT)? A recent decision (https://bit.ly/3Vb7x1h) issued by the Colombian Administrative Court (Consejo de Estado de Colombia) allowed an employer to deduct expenses incurred with the termination of employment agreements (i.e., indemnifying payments required by employment law in the event of […]

Health Taxes in LatAm: A Dual Purpose?

🌎 What do the Argentinian “Impuesto Interno a los Cigarillos” (internal tax on cigarettes), the Colombian “Impuesto a las Bebidas Ultraprocesadas Azucaradas” (tax on ultraprocessed sugar-sweetened beverages) and the new Brazilian “Imposto Seletivo” (selective tax) have in common? These are what the World Health Organization would call “health taxes”: excise taxes levied on products that […]

Government discretion in granting company-specific tax incentives

💸 What limitations should be placed on government discretion when it comes to granting company-specific tax incentives? In the article that won the Tax Notes Student Writing Competition of 2024, Nicholas Lott analyzes the polarizing company-specific tax incentive that New York offered Amazon to entice it to construct its second HQ in Long Island City. […]

Recommended articles: Tobacco Taxes and Pillar 2

🌎 Two interesting articles about tax policy issues affecting LatAm have been published by Bloomberg Tax and JOTA this week. Both are freely available and are recommended to readers by the Latin American Tax Policy Forum (LATPF): 🚬 In “OECD Tobacco Tax Report Faces Global Reforms’ Typical Obstacles”, Lucas de Lima Carvalho provides commentary on […]

Recommended articles: Cost Sharing, Environmental Tax and Anti-Abuse Clauses

📚 Here are three articles discussing local and international tax policy themes relevant for LatAm that are recommended by the Latin American Tax Policy Forum (LATPF): 💲 In “Original Sin: Cost Sharing in the United States”, Elizabeth Stevens and H. David Rosenbloom discuss the extent to which U.S. cost sharing regulations have caused much of […]

New Tax Compliance Law in Chile: Comparisons with LatAm

📜 Last month, the Chilean National Congress (Congreso Nacional de Chile) approved a new Tax Compliance Law featuring several provisions on themes of anti-tax avoidance, transfer pricing, CFC rules, VAT on digital platforms and even a 12% voluntary disclosure and repatriation tax. Ley 21.713 is part of a wider program of the Ministry of Finance […]

Recommended article: Weaponization of Interdependence for Tax Policy

🌎 Should countries be able to “weaponize” their “interdependence” on one another to effectuate global tax policy reform? In a recent paper titled “Harnessing Network Power: Weaponized Interdependence in Global Tax Policy”, Rasmus Corlin Christensen argues that countries can exploit “asymmetric networks to coerce other actors” so that they refrain “from imposing outcomes that collectively […]

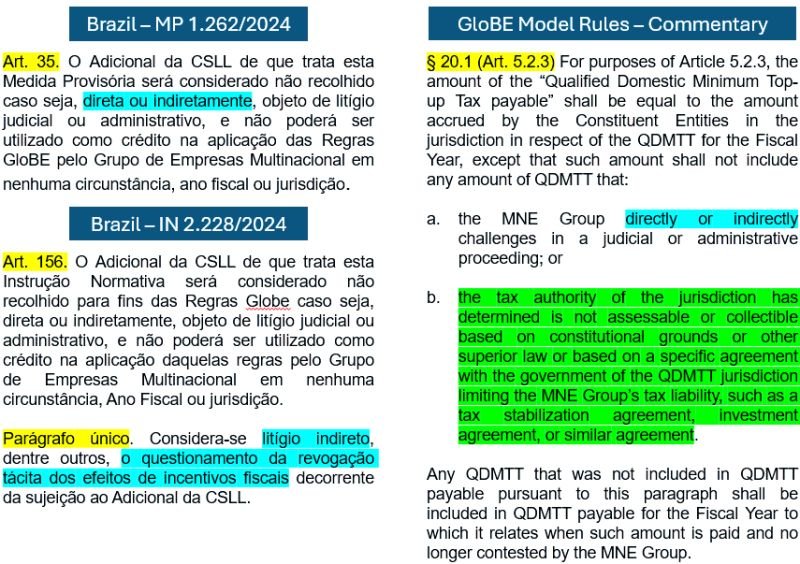

Pillar 2 and the Limitations on the Power to Litigate

🌎 Earlier today, IBDT – Instituto Brasileiro de Direito Tributário and FIPECAFI – Fundação Instituto de Pesquisas Contábeis, Atuariais e Financeiras hosted a roundtable covering tax and accounting topics relevant to Brazilian practitioners. Gabriel Bez-Batti spoke about the amortization of goodwill for tax purposes in the context of acquiring a company with negative net equity […]

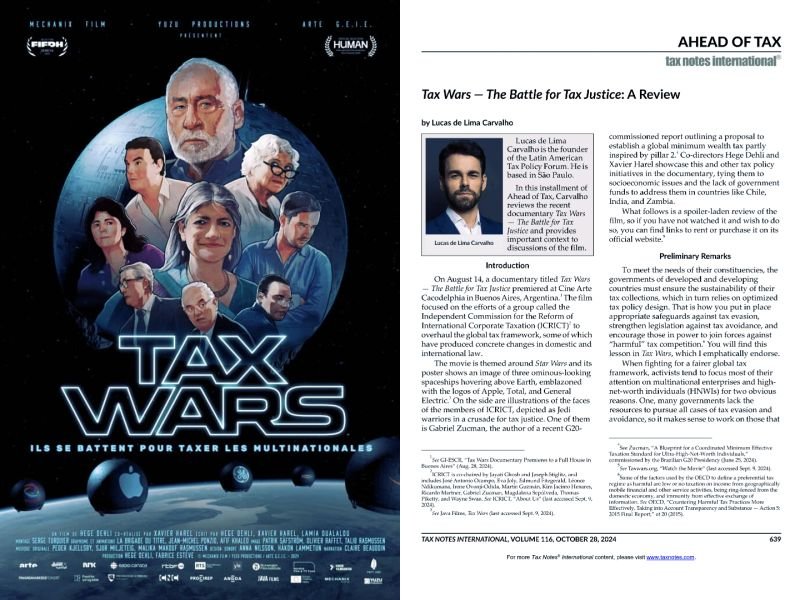

Tax Wars – The Battle for Tax Justice (A Review)

🌎 Where do the ideas that evolve into global tax policy initiatives – like the OECD – OCDE Pillar 2 or the United Nations Framework Convention on International Tax Cooperation – originate? Released earlier this year, a documentary film titled “Tax Wars – The Battle for Tax Justice” (https://taxwars.org/en/) features the work of activists and […]

Recommended articles: Double Tax Treaties, Brazilian Tax Reform and other topics

🌎 Here is a list of recommended articles from LatAm authors about matters of domestic and/or international tax policy. These are recent publications freely available online and curated by the Latin American Tax Policy Forum (LATPF): ✅ “Hollowness and Indifference in Global Tax Governance: The Cases of Haiti and Nicaragua”, by Roberto Ramos Obando. Working […]

Argentina: The Federal Tax Authority changes from AFIP to ARCA

🚨 Manuel Adorni, the spokesperson for the Presidency of Argentina, has just announced that the Federal Administration of Public Revenues (AFIP) is officially dissolved. In its place Milei’s government is creating an agency titled “Agency of Revenue Collection and Customs Control” (ARCA). In Adorni’s words (translated from Spanish): “From this day onwards, the Federal Administration […]

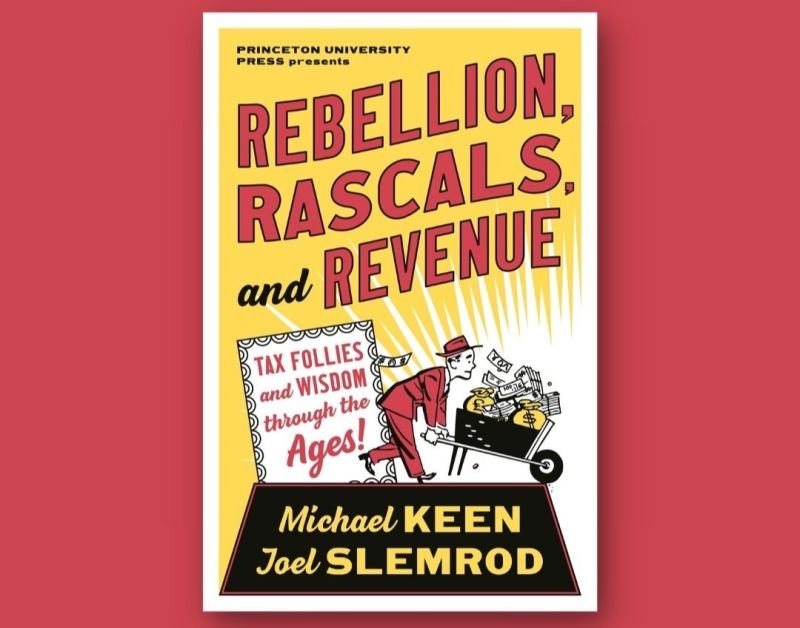

Rebellion, Rascals, and Revenue: Tax Follies and Wisdom through the Ages

📚 Michael Keen and Joel Slemrod wrote one of the most interesting books of 2021 about the history of taxation. The book is titled “Rebellion, Rascals, and Revenue: Tax Follies and Wisdom through the Ages” and it describes the ways in which rulers/elected figures used – and use – taxes to fund private and/or public […]

Pillar 2: Is it the outcome of International Cooperation?

🌎 ¿Es correcto decir que la implementación del Pilar 2 de la OECD – OCDE es resultado de la “cooperación internacional” entre los países del Marco Inclusivo? 💡En un artículo publicado recientemente en SSRN y titulado “False Idols in the Early History of International Taxation”, el Prof. Wei Cui de la The University of British […]

Recommended article: Brazil’s tax treatment of foreign trusts

🌎 This Monday, the cover piece of Tax Notes International is an article titled “The Evolution of Brazil’s Tax Treatment of Foreign Trusts” and written by Caio Malpighi. In his article, the author reviews some of the (federal and state) consultation rulings and (administrative and judicial) court decisions discussing the tax treatment of trusts in […]

Recommended events and articles: São Paulo Association of Tax Studies and University of Buenos Aires

🌎 For those that want to learn more about the OECD – OCDE Pillar 2 as a subject in tax policy design, here are two online events happening in LatAm that might be of interest to you: 1️⃣ Today, October 11, the São Paulo Association of Tax Studies (Associacao Paulista De Estudos Tributarios- Apet) will […]

Recommended series: Tax and AI

📽️ Tax and AI is a 4-episode series (https://bit.ly/3XS6YKp) that explores the tax policy challenges brought about by artificial intelligence. Throughout the series, our founder Lucas de Lima Carvalho discusses key themes such as the use of AI by tax administrations and taxpayers, how AI impacts taxable events, and the potential for AI to be […]

New Issue of Revista Debates (UBA – Argentina)

🌎 The School of Law of Universidad de Buenos Aires has just released the new issue of its prestigious Revista Debates de Derecho Tributario y Financiero. Issue 13 of Year IV is themed around Constitutional (Tax and Budgetary) Law and it is available in Spanish here: https://bit.ly/3zPsBmM Some of the articles featured in this issue […]

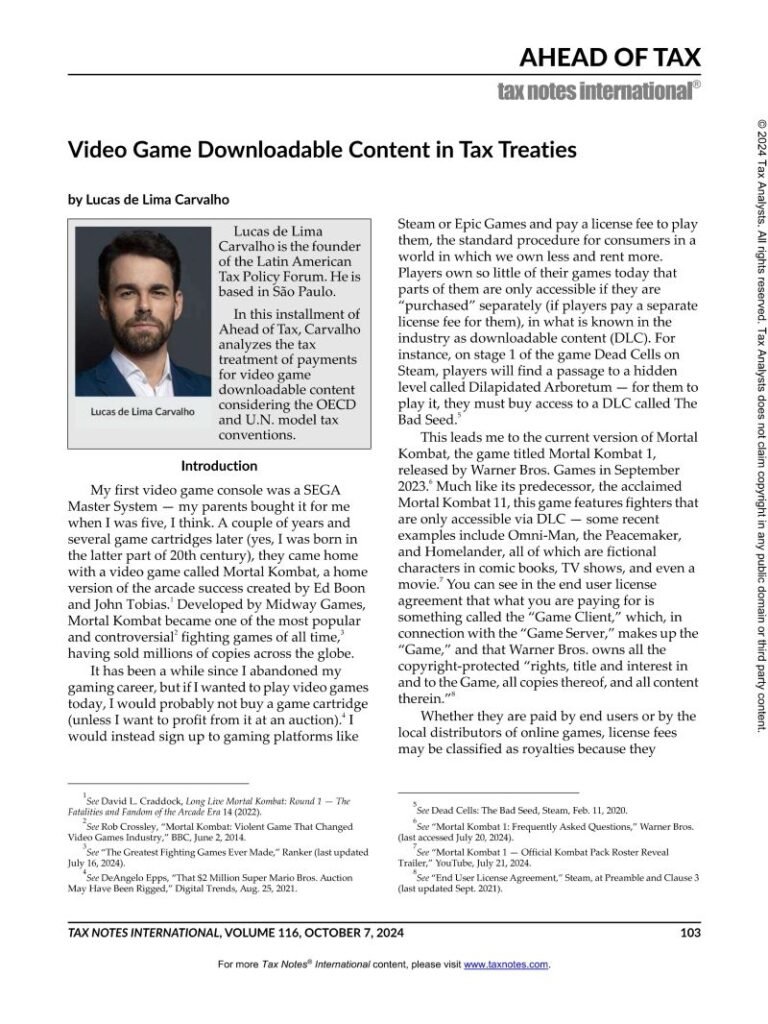

Video Game Downloadable Content in Tax Treaties

🎮 The Latin American gaming market continues to grow at an impressive rate. In 2022, more than 316 million players (with 200 million of those being active paying gamers) generated over USD 8 billion in revenue. A recent survey published by PagSeguro International shows that LatAm players purchase their games in a variety of platforms, […]

Brazil implements Pillar 2

🌎 Brazil has officially implemented (some of) the GloBE rules of OECD – OCDE Pillar Two. The full text in Portuguese is available here (https://bit.ly/47UDWhU) and as a PDF attached to this post. This is a Provisional Measure that has to be converted into law in up to 60 days (or 120 days if the […]

OECD Report: Tax Policy Reforms 2024 – OECD and Selected Partner Economies

🌎 The OECD – OCDE released today the 9th edition of their report titled “Tax Policy Reforms 2024: OECD and Selected Partner Economies”. This is an annual publication that provides comparative information on tax reforms across countries and tracks tax policy developments over time. The report covers the tax policy reforms introduced or announced in […]

New Issue of Caribbean Tax Law Journal (IFA – Caribbean)

🌎 The IFA Branch Curaçao-Aruba-Sint Maarten has just released the new edition of their prestigious Caribbean Tax Law Journal (edited by Leopoldo Parada). This sixth edition features articles from prominent international tax experts that are relevant not only for the Caribbean as a region but also for neighboring Latin American countries. Here is the link: […]

New Issue of Revista Direito Tributário Atual (IBDT – Brazil)

🌎 El 23 de septiembre, el IBDT – Instituto Brasileiro de Direito Tributário lanzó la nueva edición de su prestigiosa Revista Derecho Tributario Actual (Revista Direito Tributário Atual). A pesar de que sus artículos abordan la doctrina nacional brasileña, sus reflexiones pueden ser útiles para investigadores y profesionales de otros países de LatAm, particularmente en […]

Peru: SUNAT defines “service” in “intragroup services”

🌎 On September 9th, the Peruvian tax authority (SUNAT) released a very interesting consultation ruling – and we thank Roberto E. Polo Ch. for sharing it with his comments. In Informe N.º 000070-2024, SUNAT is asked whether the “benefits test” of Art. 32-A of the Peruvian Income Tax Law (part of the local transfer pricing […]

EU: The ECJ decision in the Apple case

🌍 In what is likely the most surprising court decision of 2024, the Tribunal de Justiça da União Europeia has just released their judgment on the famous Apple case – the ECJ sets aside the General Court’s ruling and agrees with the European Commission that Ireland granted unlawful State Aid to Apple from 1991 to […]

Recommended course: Tributación Internacional Corporativa (UCEMA – Argentina)

🌎 Next week, the University of CEMA (Universidad del CEMA) will host the first online class of the new edition of its course titled “Tributación Internacional Corporativa: Proyección Fiscal Internacional de las Organizaciones”. This online course is offered in Spanish and it is a part of UCEMA’s Executive Education platform UCEMAX – Educación Ejecutiva. The […]

Recommended article: Argentina’s Tax Reforms Aim to Change the Game for Investors

🌎 You can find different sorts of tax policy design choices in the diverse landscape of LatAm countries today. Roberto Ramos Obando recently covered in Tax Notes the Tax Justice Bill in Honduras, which was proposed by the local government to “ensure a more equitable distribution of the fiscal burden and to enhance the state’s […]

New Issue of Revista Jurídica da Presidência da República (Federal Government – Brazil)

🌎 The Presidency of the Republic of Brazil (Presidência da República) has just released Volume 26, Number 139, of its prestigious Law Journal (“Revista Jurídica da Presidência”). Two of its articles explore tax topics that are relevant for Brazilian scholars/practitioners and that might be of interest to a wider LatAm (and global) audience. They are: […]

Recommended events: UBA (Argentina), IBDT (Brazil) and ABDF (Brazil)

🌎 Esta semana y la próxima, los profesionales tributarios de América Latina podrán asistir a dos eventos gratuitos sobre la cooperación tributaria internacional y la adopción del Pilar 2 de OECD – OCDE. Ambos eventos se transmitirán online. Titulado “Incentivos y desincentivos para la Cooperación Fiscal Internacional en America Latina”, el primer evento tendrá lugar […]

Recommended event: IFA LATAM

🌎 Los proveedores de servicios de pago continúan revolucionando las oportunidades de acceso a productos y servicios para clientes en América Latina. En el informe del Banco Interamericano de Desenvolvimento titulado “Ecosistemas de Pagos Digitales en América Latina y el Caribe” (elaborado por Diego Herrera, Veronica Lopez Sabater y Ana Maria Zárate Moreno), se dice […]

Recommended event and articles: ABDF and Pillar 2

🌎 Ayer por la tarde, la Asociación Brasileña de Derecho Financiero (ABDF Direito Financeiro) organizó el evento titulado “El Proyecto Brasileño de Tributación Mínima Global”, oportunidad en la que representantes de la Hacienda Federal de Brasil, profesionales y académicos del área tributaria pudieron discutir la futura implementación de las reglas GloBE del Pilar 2 de […]

Recommended articles: Moore v. United States and its possible adoption in LatAm

🌎 This week, Tax Notes International features two articles from LatAm authors about the extraterritorial impact of The Supreme Court of the United States decision in Moore v. United States (https://bit.ly/3YDtCIm). One article is titled “Brazil and U.S. Both Debate the Realization of Taxable Income”, and it is authored by Caio Malpighi and Leonardo Aguirra […]

Chile: Senate debates a proposal to implement UBO legislation

🌎 The Chilean Senate is now debating a (resurfaced) proposal to implement an ultimate beneficial ownership (UBO) registry in the country (https://bit.ly/3WVjV6Q). This is in line with Recommendation 24 of the Financial Action Task Force (FATF) as well as guidelines issued by the OECD – OCDE Global Forum on Transparency and Exchange of Information for […]

IBFD announces free e-book resources

🌎 El 22 de julio, IBFD anunció que más de 50 de sus libros están disponibles para descarga gratuita en su sitio web (https://bit.ly/3WsUAjr). Son publicaciones del año 2001 al 2014, siendo la más reciente de ellas el libro “The Nordic Multilateral Tax Treaty as a Model for a Multilateral EU Tax Treaty”, de la […]

Recommended articles: Anti-abuse rules in Chile, Consumption Taxes, AI and more

🌎 Si bien muchos académicos y profesionales publican sus artículos sobre asuntos fiscales en revistas y diarios especializados en tributos, a menudo vemos artículos sobre temas tributarios relevantes que aparecen en revistas jurídicas y contables generales. Parte de la misión del Latin American Tax Policy Forum (LATPF) es promover la investigación en materia de política […]

Denial of FTC for income taxes imposed by illegitimate governments

💵 Can a country deny a Foreign Tax Credit (FTC) for income taxes from another country if it does not recognize the legitimacy of its government? In an article titled “FTCs and the ‘Two-State Problem’: Recognizing Contested Governments for Tax Purposes” and published by Tax Notes International on June 15, 2020, Ben Satterthwaite discussed this […]

Recommended article: Expanding the definition of royalties in Australia

🌏 Should a domestic definition of royalties be able to expand on the definition found in (a) bilateral tax treaties or (b) international tax practice? By and large, Latin American tax treaties follow the United Nations Model Convention when it comes to Art. 12 (“Royalties”). Unlike its equivalent in the OECD – OCDE Model Convention, […]

Recommended book chapter: Tax reform in Honduras

👷♀️ Why do tax systems go through “reforms”? In fact, at what point does an adjustment to a particular tax or set of taxes in a system become a “tax reform”? In recent years, LatAm countries have witnessed (and are witnessing) significant reforms of their local tax systems. Brazil is going through that process in […]

Secrecy-seeking capital in the global economy

💱 Secrecy-seeking capital has been a key concern for global – and LatAm – tax policy for decades. With the advent of crypto as a new medium for financial transactions, governments are increasingly concerned about the obsolescence of the measures they have in place to “shed light” on the hidden assets of tax evaders and […]

Recommended article: CFC rules in LatAm

🌎 In a recent post published on Taxlatam and titled “Controlled Foreign Corporation Rules en LATAM: Volumen II”, Francisco Tochetti, Sebastian Cersosimo and Manuel Lessa Stewart highlight a number of new and important developments in the CFC rules of Brazil, Ecuador and Chile. The authors also compare those to the CFC rules in Spain and […]

The OECD, the Inclusive Framework and LatAm

🌎 Desde 2019 (o desde 2013), los países latinoamericanos han sido “invitados” a discutir ciertos temas de política fiscal global con miembros de la OECD – OCDE en un foro presidido por la OCDE, incluidos (1) la tributación de la economía digital en el país donde se sitúa el mercado de consumo y (2) la […]

New Issue of Revista Debates (UBA – Argentina)

📘 The Centro de Estudios Derecho Financiero y Derecho Tributario of the Universidad de Buenos Aires School of Law has just released the new issue of their prestigious Revista Debates de Derecho Tributario y Financiero (Año IV, Nº 11). You can find its PDF available for free here (in Spanish): https://bit.ly/3xNyTlR This issue includes articles […]

Peru: An Interesting Precedent about Beneficial Ownership

🌎 After Action 6 of the OECD – OCDE BEPS Action Plan, it is fair to say that “beneficial ownership” has become something of a secondary filter against treaty shopping. Far more attention has been devoted to the Principal Purpose Test (PPT) in recent years, and many tax treaties have either been signed with it […]

New Issue of the CIAT Tax Administration Journal

🌎 The Interamerican Center of Tax Administrations (Centro Interamericano de Administraciones Tributarias – CIAT) has just released the June issue of its prestigious Tax Administration Journal (Revista de Administración Tributaria). The publication is directed by Marcio Ferreira Verdi, who is also a member of its Editorial Board together with Santiago Díaz de Sarralde Miguez and […]

Saint-Amans and the Memoir “Paradis Fiscaux: Comment on a changé le cours de l’histoire”

📚 In his memoir titled “Paradis fiscaux: Comment on a changé le cours de l’histoire (French Edition)”, Pascal Saint-Amans recounts the negotiations that took place between more than 140 jurisdictions (including OECD – OCDE members, G20 Brasil 2024 countries and others) to advance global tax policy standards during his tenure as Director of the Centre […]

The IFA LATAM Annual Conference is concluded in Rio de Janeiro

🌎 El encuentro latinoamericano de la International Fiscal Association en Río de Janeiro los días 25, 26 y 27 de junio reunió a expertos y autoridades fiscales de diversos países para debatir temas cruciales en el área tributaria. Uno de los principales puntos abordados fue la implementación de políticas fiscales justas y eficientes, con énfasis […]

New issue of Revista de Derecho Fiscal (UExternado – Colombia)

📚 This week’s highlights include an article titled “Revisiting Tax Treaty Interpretation Under the Vienna Convention” and written by Pitambar Das and Vaidehi Krishna for Tax Notes International. The article examines “whether general rules of interpretation of treaties under the VCLT need revisiting in the context of tax treaties in light of an emerging judicial […]

Recommended event: TEI Seminar – Best Practices in Tax Management

🖥 No dia 1º de julho, das 16:00 às 17:30, o Tax Executives Institute LatAm e o TEWA Tax Experts apresentarão um evento intitulado “Melhores Práticas para Gestão Tributária na América Latina: Ampliando Escopo do Gestor BR”. Os palestrantes serão Bruna Futuro (Meta), Juliana Zobaran (Vantiva) e Lionel Nobre (Dell Technologies). A moderação será de […]

The U.S. Supreme Court issues their ruling on Moore v. United States

🌎 Today the U.S. Supreme Court published their much-anticipated decision on Moore v. United States, and it is a (debatably) narrow victory for the government. Justice Brett Kavanaugh delivered the opinion of the Court (by a 7-2 majority, with Justices Jackson and Barrett having filed concurrent opinions, and Justice Thomas having filed a dissent). The […]

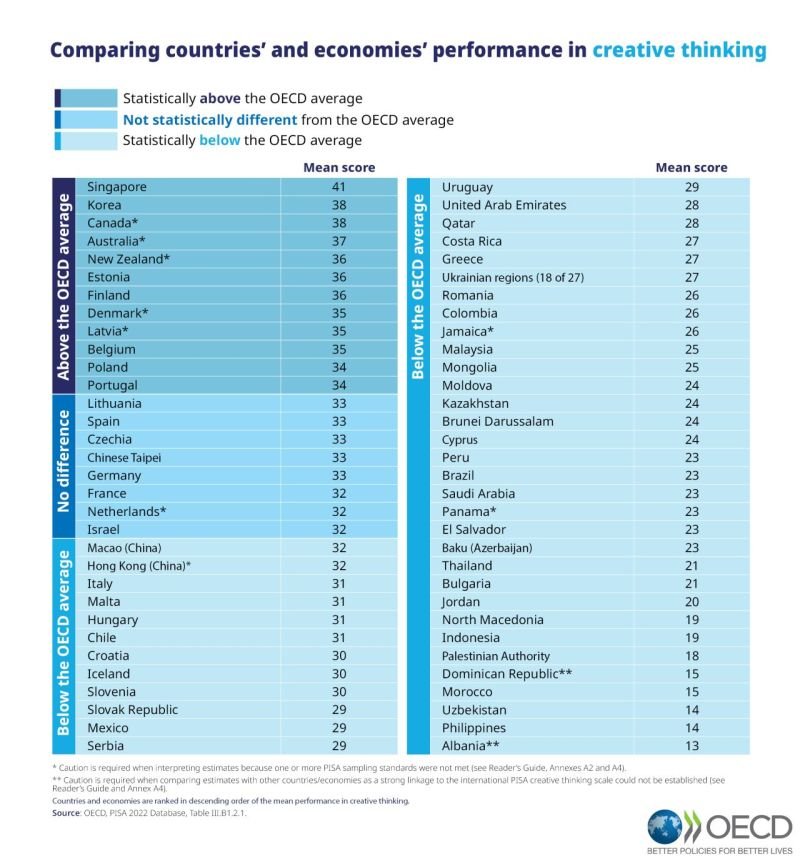

Recommended articles: Tax and Support for Educational Initiatives in LatAm

📚 Varios países de América Latina adoptan herramientas de política fiscal y tributaria para fomentar la educación. Nos queda un largo camino por recorrer, como se muestra en el Volumen III del informe del Programa para la Evaluación Internacional de Estudiantes (PISA) de 2022, publicado hoy. Según la OECD – OCDE, PISA mide la capacidad […]

Recommended article: AI Prompt Engineering and Tax Treaties

🌎 This Monday, the cover piece of Tax Notes International is an article co-authored by Lucas de Lima Carvalho, Raphael de Campos Martins and Gabriel Bez-Batti. The article is titled “AI Prompt Engineering and the U.N. Model Treaty” and it explores the implications of AI prompt engineering for the qualification of technical services as such […]

Recommended course: Diploma de Procedimientos Tributarios (Univ. Concepción – Chile)

⚖ La Universidad de Concepción ha abierto inscripciones para su “Diploma de Procedimientos Tributarios”, que se realizará 100% online y durará 108 horas. Las clases se harán los martes y jueves de 18:30 a 21:00 horas, a partir del 18 de julio de 2024. El diplomado entregará a los participantes una visión general de las particularidades de […]

Recommended course: Diplomado en Tributación – CIAT

🌎 El Centro Interamericano de Administraciones Tributarias – CIAT ha abierto las inscripciones para la 13ª edición de su curso titulado “Diplomado en Tributación”, con el tema “Administración Tributaria”. El curso tiene como objetivo suministrar a los funcionarios y público en general de los países de LatAm y del Caribe, Europa y África, conocimientos generales […]

Recommended article: The Impact of Deferred Taxes on Business Combinations

📚 El autor Ramon Tomazela recientemente publicó un artículo titulado “Os Impactos de Tributos Diferidos em Combinações de Negócios” (“Los Impactos de los Impuestos Diferidos en las Combinaciones de Negocios”) en el Volumen 6, Número 11, de la Revista de Direito Contábil Fiscal da APET – Cursos Tributários (APET Direito Tributário). El artículo en portugués […]

New Issue of Revista Direito Tributário Atual (IBDT – Brazil)

📘 El prestigioso IBDT – Instituto Brasileiro de Direito Tributário publicó el número 56 de su “Revista Direito Tributário Atual”. Los editores Fabiana Carsoni Fernandes y Fernando Zilveti presentan a los lectores de este periódico artículos científicos sobre diversos temas relacionados con el Derecho Tributario en Brasil. La lista completa de los artículos (escritos en […]

Recommended article: Fraudulent AI as an Agent PE

🤖 This week’s issue of Tax Notes International features an article titled “Fraudulent AI as an Agent PE” and written by our founder, Lucas de Lima Carvalho. His piece explores the interplay between Art. 5(5) of the OECD – OCDE and United Nations Model Conventions, their references to “the principal role leading to the conclusion […]

OECD: Consolidated Commentary to the GloBE Model Rules

🌎 The OECD – OCDE has just published the Consolidated Commentary to the Global Anti-Base Erosion (GloBE) Model Rules of Pillar Two. The document has over 300 pages and aggregates administrative guidelines that were published about Pillar Two since the publication of the GloBE Model Rules in December of 2021. Several countries have already adopted […]

New Issue of Revista Debates (UBA – Argentina)

📚 The School of Law of the University of Buenos Aires (Universidad de Buenos Aires Facultad de Derecho, Universidad de Buenos Aires) recently published the two Volumes of Issue 10 of their prestigious “Debates” Law Review (“Revista Debates de Derecho Tributario y Financiero”). This Issue is themed around “Human Rights Principles and Tax Policy” and […]

Recommended article: Taxation by Analogy in LatAm Jurisprudence

🌎 This week, Tax Notes International features an article written by Larissa Torhacs and titled “Taxation by Analogy in Latin American Jurisprudence”. In it, the author analyzes an impressive total of fifteen precedents about analogy and tax matters (emanating from courts in Argentina, Brazil, Colombia and Mexico). She draws conclusions from her analysis and applies […]

Brazil: Essence over Form of Charter Party Agreements

🚢 In a split decision dated February 20 and published on March 28, 2024, the 3rd Chamber of CSRF in Brazil (Superior Administrative Court of Tax Appeals) stated that tax authorities are allowed to consider the “essence” of a charter party agreement instead of its “form”, particularly if that “form” is used to shield the […]

Recommended article: Tax Justice Bill Stirs Controversy in Honduras

🔷 This Monday’s issue of Tax Notes International features an article titled “Tax Justice Bill Stirs Controversy in Honduras”, by Roberto Ramos Obando. This is an article about the Honduran Tax Justice Bill, a four-pronged initiative consisting of (1) the Tax Justice Law, (2) the tax justice constitutional reform, (3) the ratification of the Multilateral […]

The Link between Bright-Line Tests and Tax Avoidance

👨⚖️ What is the link between bright-line tests and tax avoidance? In a paper titled “Judicial Line Drawing and Implications for Tax Avoidance” and recently published in the Canadian Tax Journal, Ivan Ozai explores the differences between bright-line and what he calls “multifold” rules in tax legislation. The author categorizes these into bright-line and multifold […]

New Issue of the Caribbean Tax Law Journal (IFA Caribbean)

📚 The IFA Branch Curaçao-Aruba-Sint Maarten has recently released Edition 5 of their prestigious Caribbean Tax Law Journal. It features articles written by prominent tax experts across the globe. Here is the list of this Edition’s articles accompanied by other publications recommended as supplementary sources by the Latin American Tax Policy Forum (LATPF): ✅ “Policy […]

Peru: Precedent on the Difference between Royalties and Software License Payments

⚖ A Peruvian Tax Court decision issued on December 1st, 2023, and originally shared by Roberto E. Polo Ch. addresses the differences between royalty payments and the price paid for software licenses for tax purposes. The full PDF of the court decision in Spanish is attached to this post. The case revolves around payments for […]

Recommended article: The Alleged Similarity between CFC rules and the IIR

🌍 This week’s issue of Tax Notes International features an article written by our founder Lucas de Lima Carvalho about the alleged similarity between the OECD – OCDE Pillar 2 Income Inclusion Rule (IIR) and Controlled Foreign Company (CFC) rules known and applied in many countries. As said by the author: “[T]he statement found in […]

New Issue of Revista de Derecho Tributario (Univ. Concepción – Chile)

📚 Recently issued by Universidad de Concepción in Chile, Volume 14 of their Revista de Derecho Tributario features noteworthy contributions from several authors. Their articles are written in Spanish and are listed with additional references for further research below: ➡ “Tributación de la compraventa de obras de arte” (Taxation of the sale and purchase of […]

New Issue of Revista Direito Tributário Internacional Atual (IBDT – Brazil)

📚 El prestigioso IBDT – Instituto Brasileiro de Direito Tributário recientemente publicó el Número 12 de su conocida “Revista de Direito Tributário Internacional Atual”, editada por Roberto França Vasconcellos, Victor Polizelli y Renata Emery. Los artículos de esta revista están escritos en portugués e incluyen: ▶ “Dedução de Despesas com Juros: o Viés do Débito, […]

Ecuador: Organic Law for Economic Efficiency and Job Creation

🕹 On December 20, 2023, the Asamblea Nacional del Ecuador approved their Organic Law for Economic Efficency and Job Creation (“Ley Orgánica de Eficiencia Económica y Generación de Empleo”). One of the many amendments made by this law to the Ecuadorian Internal Revenue Code (LRTI) is the addition of CFC rules, the first of their […]

The Interplay between AI and Taxation

🐇 Earlier today, rabbit inc. released their AI-based device called “r1”. This is a device that enables users to make use of AI (in what they call “Large Action Model” (LAM) as opposed to “Large Language Model” (LLM)) to do things on their behalf. This includes ordering food, booking rides or trips, writing documents and […]

Recommended article: The Meaning of Control in CFC Rules

🎮 Next week’s cover piece of Tax Notes International is an article written by our founder, Lucas de Lima Carvalho, and featured in his column “Ahead of Tax”. The article addresses the importance of control in the taxation of controlled foreign corporations and reviews the ordinary meaning of the word and how it relates to […]

Recommended journals: Blas Pascal, IBDT and UExternado

📚 Universidad Blas Pascal, IBDT – Instituto Brasileiro de Direito Tributário and Universidad Externado de Colombia have recently released their journals featuring articles from LatAm and non-LatAm experts about tax topics ranging from fiscal secrecy to anti-abuse clauses. Articles have been published in Spanish, Portuguese and English, and are freely available online. These articles include: […]

Brazil: New Law on the Taxation of Trusts and CFCs owned by Individuals

💵 A principios de la década de 1980, con el objetivo de dar a conocer a la población el nuevo Programa de Declaración del Impuesto sobre la Renta, el Ministerio de Hacienda de Brasil lanzó una campaña publicitaria en periódicos, radio y TV del país. Los anuncios mostraban a un león merodeando alrededor del contribuyente […]

The Treatment of Servers as PEs in Tax Treaties

⚡ Can a server be regarded as a Permanent Establishment (PE) under Article 5th of existing tax treaties? The tax treaty signed by Curaçao and San Marino on November 20, 2023 (available here: https://shorturl.at/J2789), features in its Art. 5(3)(c) a provision stating that “a server or other type of electronic equipment of an enterprise of […]

Colombia: Decree defines rules for “Significant Economic Presence”

📜 The Colombian government has issued a new decree (Decree 2039/2023, available in Spanish here: https://shorturl.at/juCDQ) that regulates the concept of “Significant Economic Presence” (SEP) as a nexus criterion for Corporate Income Tax (CIT) liability. This targets non-resident entities that provide digital services or sell goods online to Colombian clients or users. Some of the […]

Brazil: Tax Impacts of Capital Redemptions

💸 ¿Cuáles son los efectos fiscales de las operaciones de “retorno de capital” en Brasil? Este es el tema del artículo titulado “O Regime Tributário das Devoluções de Capital” (“El Régimen Tributario de los Retornos de Capital”) y publicado por el autor Gabriel Bez-Batti en la Revista de Direito Contábil Fiscal (Volumen 5, Número 10) […]