🌎 Earlier today, IBDT – Instituto Brasileiro de Direito Tributário and FIPECAFI – Fundação Instituto de Pesquisas Contábeis, Atuariais e Financeiras hosted a roundtable covering tax and accounting topics relevant to Brazilian practitioners. Gabriel Bez-Batti spoke about the amortization of goodwill for tax purposes in the context of acquiring a company with negative net equity (uncovered liabilities). Ramon Tomazela and Éric Aversari Martins discussed the new CSLL surtax in Brazil (the OECD – OCDE Pillar 2 QDMTT) and its alignment with Brazilian Accounting Standards (BR GAAP, largely based on IFRS).

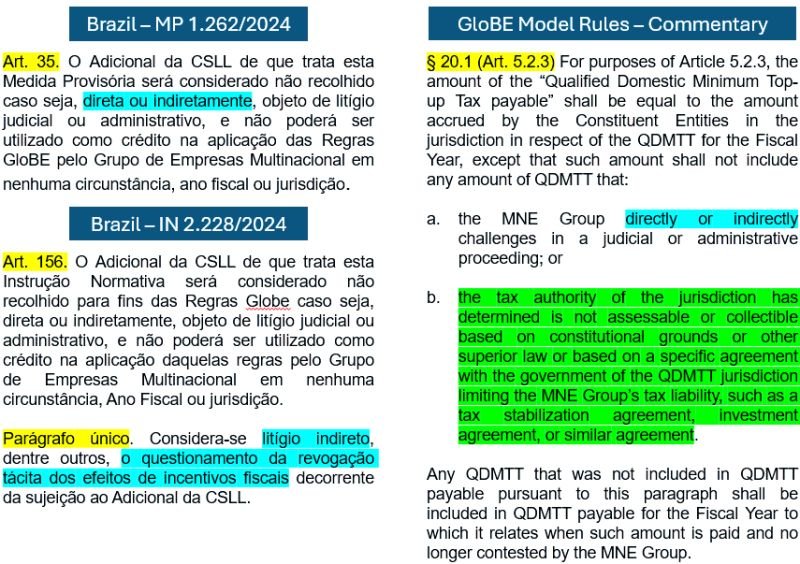

During the event, Ricardo Mariz de Oliveira asked attendees whether other Pillar 2 legislation around the world features a provision like Art. 35 of Provisional Measure 1,262/2024 in Brazil (pictured with its equivalent in Normative Instruction RFB 2,228/2024 and compared to § 20.1 of the Commentary to Art. 5.2.3 of the GloBE Model rules below). After the event, we have found and compiled a short list of similar provisions found in GloBE legislation elsewhere:

✅ Art. 32 of Belgian Act 2024004641 (which amends Art. 22, § 3rd, of Belgian Act 2023048529). https://lnkd.in/dbrpXeGC

✅ Interpretation (Part 4A) of the EU Council Directive 2022/2523 in Ireland (see definition of “qualified domestic top-up tax payable” on p. 136). https://lnkd.in/daMrPxyC

✅ Art. 16(4)(d) and Art. 24(5)(d) of the Multinational Enterprise (Minimum Tax) Act of Singapore. https://lnkd.in/dpZ755Sm

💡 The interesting aspect of this provision – a denial of QDMTT allocation if the tax is effectively not collected for reasons outside the control of the tax administration – is that it could align both the local taxpayer and tax authority with political and economic interests regarding GloBE. What if the taxpayer deposits the challenged amount in court? The group may effectively face “double economic taxation” by depositing a [challenged] QDMTT while paying an IIR or UTPR elsewhere.

📚 This touches upon the yet-to-be-explored point of dispute resolution not between taxpayers and tax authorities, but between GloBE implementing jurisdictions. For more information on the topic, see Tatiana Falcão’s article for Tax Notes International (at the invitation of the International Tax and Investment Center) titled “Can GLOBE Rule’s Pillar 2 Dispute Resolution Deliver Legal Certainty?”. Available here: https://bit.ly/3UtGFcE