🌎 Where do the ideas that evolve into global tax policy initiatives – like the OECD – OCDE Pillar 2 or the United Nations Framework Convention on International Tax Cooperation – originate?

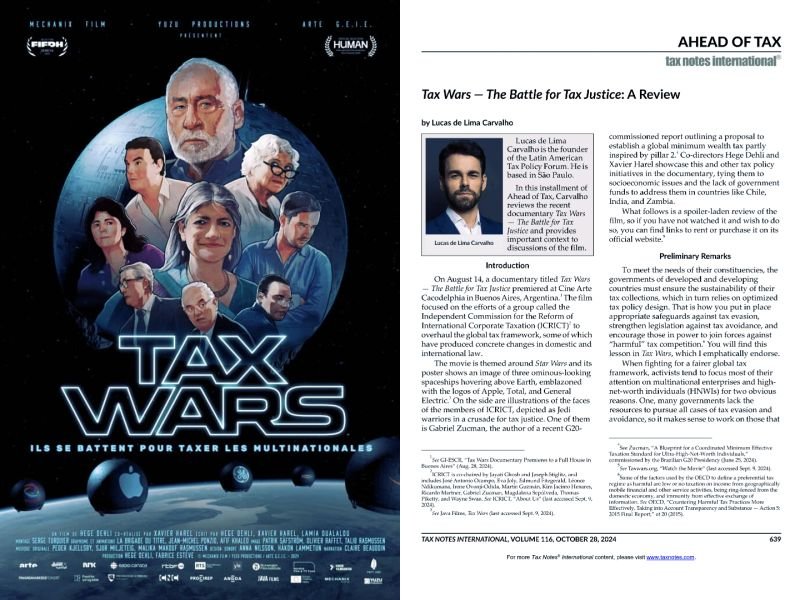

Released earlier this year, a documentary film titled “Tax Wars – The Battle for Tax Justice” (https://taxwars.org/en/) features the work of activists and policymakers of the Independent Commission for the Reform of International Corporate Taxation (ICRICT). These include prominent figures like Magdalena Sepulveda Carmona, Eva Joly, José Antonio Ocampo and also Gabriel ZUCMAN, the author of a recent proposal to impose a global minimum wealth tax on UHNWIs (commissioned by the G20 / G20 Brasil 2024).

The film raises crucial questions about the state of global tax policy today, showing how influential policy initiatives are born – often amid social unrest and in response to artificial tax arrangements that benefit some while disadvantaging many. As stated by Alex Cobham at the end of the movie, “[y]ou don’t like paying taxes? I don’t like paying taxes, but do you know what? We all live better lives when we have better taxes.”

Today, Tax Notes published an article by Lucas de Lima Carvalho offering a detailed review of Tax Wars – the review is laden with spoilers, so be aware of that before you read it. While Carvalho notes that the film is “profoundly biased” against MNEs and HNWIs, he underscores the importance of optimizing tax policy to support sustainable revenue collections in Latin America and beyond. Carvalho suggests that the path to meaningful change lies in debating tax policy ideas on their merits, allowing all sides to share their perspectives, “including a discussion about the necessary limits of supranational control over domestic tax policy.”

Carvalho’s article is available here: https://bit.ly/4faYaq6 💡 For more on tax policy trends in Latin America, here are a few recommended papers by the Latin American Tax Policy Forum (LATPF):

✅ “Impuestos globales sobre las emisiones de gases de efecto invernadero: un entretejido democrático entre justicia fiscal y climática”, by Francisco Mata Machado Tavares and Carolina L. Gonçalves. Published by Pontifícia Universidade Católica do Paraná (2024). Available in Spanish: https://bit.ly/3YCTILb

✅ “Global Minimum Taxation: A Strategic Approach for Developing Countries”, by Leopoldo Parada. Published by Columbia Law School (2024). Available here: https://bit.ly/4hexhn7

✅ “Promoção de bem-estar social a partir de políticas públicas de renda em países da OCDE e relação com políticas fiscais”, by Luciano Botelho, Thiago M. T. da Costa, João Paulo De Oliveira Louzano and Davi A. S. de Lelis. Published by Universidade de Brasília (2024). Available in Portuguese: https://bit.ly/3YjhzON

✅ “Policy drift in ideologically heterogeneous governments: tax policy in Latin America”, by Eduardo Lazzari. Published by FGV – Fundação Getulio Vargas (2022). Available here: https://bit.ly/3AmRwhy