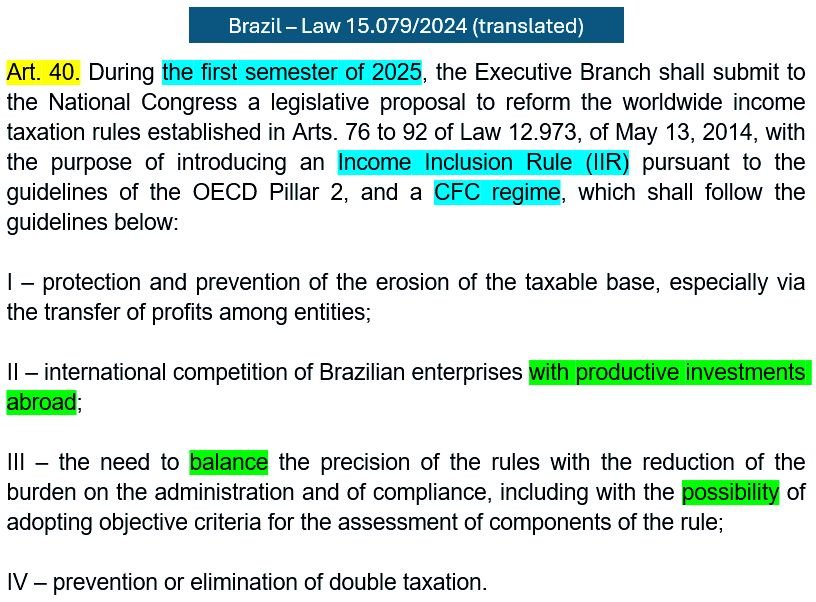

🪃 One of the more intriguing provisions of the law that implemented the QDMTT in Brazil – Law 15.079/2024 (https://bit.ly/4h5Sv5r) – is in its Art. 40. It is a strange article even outside of Tax Law because it is sort of a “boomerang” order: Congress is ordering the Executive Branch to submit a two-pronged bill of law (or perhaps 2 bills of law) back to its Houses within a specified timeframe.

🌎 Optics is the only logical explanation for Art. 40 insofar as it refers to the IIR. It is as if Congress is telling the world that it is amenable to the OECD – OCDE Pillar 2 IIR and that Brazil will adopt it soon. The substantive aspect of this portion of Art. 40 is a different matter entirely: whether Congressmembers are genuinely in favor of the IIR and understand its implications. For context, see a recent post in which Lucas de Lima Carvalho describes the voting session that approved the QDMTT in the Brazilian Senate. It took 15 minutes and was concluded with a “symbolic” vote: https://bit.ly/3C5VRGT

✏️ The way the text is written in Portuguese gives the impression that the current Brazilian CFC rules are not a “proper” CFC regime. Also, the 4 guidelines that follow the header of Art. 40 refer to the (future) CFC regime only: the word “shall” in Portuguese is “deverá” and, after Art. 40’s reference to the CFC regime, it is used in the singular.

📚 There is a lively debate on whether the Brazilian CFC rules qualify as a “proper” CFC regime, which is important if you take the view that a “typical” CFC regime is aligned with Art. 7(1) of the OECD Model and that “atypical” CFC regimes would not be. See, for example, “TBU não é CFC”, by Gabriel Bez-Batti. Published by IBDT – Instituto Brasileiro de Direito Tributário in Revista Direito Tributário Atual (2024, p. 193-197). Available in Portuguese: https://bit.ly/3CaxyHK

➡️ Stating that calling the Brazilian rules a CFC regime would be “misleading”, see “CFCs and Tax Treaties: Historical Elements for the IIR Debate”, by Pedro Guilherme Lindenberg Schoueri and Ricardo André Galendi Júnior. Published by Wolters Kluwer in Intertax (2024, p. 80): https://bit.ly/3SPelkh

⬅️ In contrast, stating that the Brazilian CFC rules do qualify as a CFC regime (but are still incompatible with the objective scope of Art. 7(1) of the OECD Model), see “Revisiting the Similarity Between CFC Rules and the IIR”, by Lucas de Lima Carvalho. Published by Tax Notes in Tax Notes International (2024, p. 611): https://bit.ly/3UdOoL0

❓ The guidelines laid out in the 4 items of Art. 40 actually raise a few important policy questions. Among them:

🔶 Would item I accommodate an anti-deferral mechanism within the future CFC rules? Or would it have to be anti-abuse only?

🔷 What is the definition of “productive investments abroad”?

🔶 How do you achieve the “balance” referred to in item III? Is there a difference between “the possibility of adopting objective criteria” and “objective criteria”?