🌎 How have LatAm courts ruled on the taxation of stock options (or similar equity-based incentives) in recent cases?

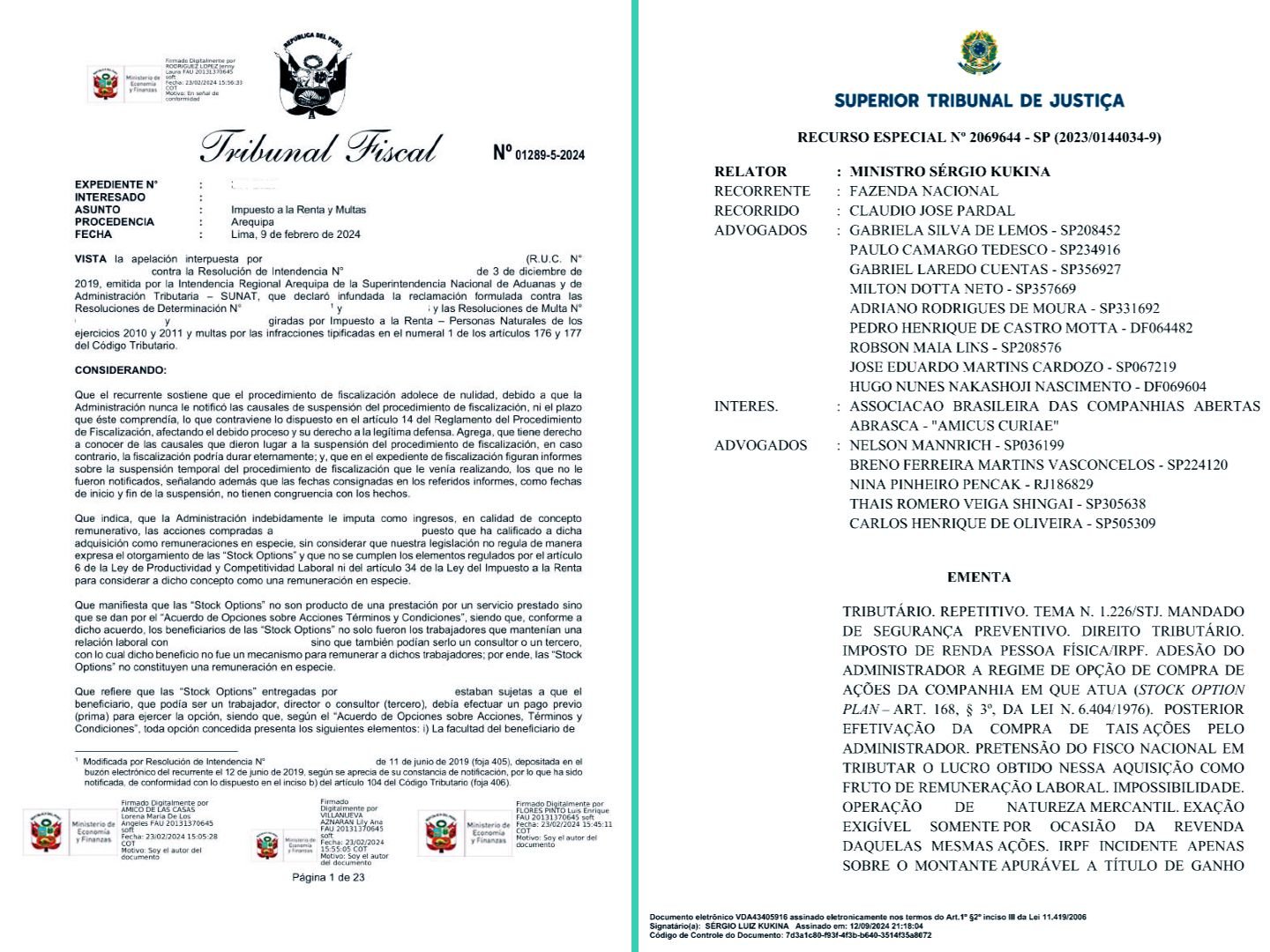

🔴⚪ In a ruling issued on February 9th, 2024, and shared by Roberto E. Polo Ch. earlier this week (https://bit.ly/3DVdlq0), the Peruvian Tax Court (Tribunal Fiscal del Ministerio de Economía y Finanzas del Perú) stated that stock options shall be treated for tax purposes as ordinary income (remuneration for services) even considering:

1️⃣ That the taxpayer paid – or was required to pay – a price for their acquisition (p. 17).

2️⃣ That the stock option plan benefited not only employees (like the taxpayer) but also external consultants and third parties – what mattered for the court was that the stock option was granted to the target taxpayer by consequence of an employment contract (p. 17).

3️⃣ That the triggering event of the tax on “ordinary income” is the exercise of the options and the taxable basis is (a) the market value of the shares on the exercise date less (b) the price paid for the vested options – this is not viewed by the court as a capital gain, but rather as ordinary income because of its “source” (the employment contract) (p. 18).

🟢🟡 In a binding precedent published on September 18, 2024, the Brazilian Superior Court of Justice (Superior Tribunal de Justiça (STJ) decided two cases (REsp 2069644/SP (https://bit.ly/3CjYpRL) and REsp 2074564/SP (https://bit.ly/40yj2mP) referring to the taxation of stock options. The resulting precedent is laid out in a court statement called “Thesis” 1.226 (https://bit.ly/42krO8W). It says:

🅰️ Stock Option Plans are commercial in nature. Optionholders are therefore not subject to the individual income tax at the moment they acquire the shares under a Stock Option Plan, given the non-existence of any accretion to wealth for them.

🅱️ The individual income tax shall be imposed on the acquirer of the shares under a Stock Option Plan when they sell those shares with a corresponding capital gain.

✏️ If you are interested in learning more about the taxation of stock options in LatAm, see below a list of articles on the topic recommended by the Latin American Tax Policy Forum (LATPF):

▶️ “Aspectos tributarios de acciones de la empresa empleadora para trabajadores de ésta”, by Juan Pablo Cavada Herrera. Published by Biblioteca del Congreso Nacional (2020): https://bit.ly/40xqXAM

▶️ “Taxation of Executives in Mexico”, by Francisco J Peniche Beguerisse. Published by Lexology (2020): https://bit.ly/3WmjYIf

▶️ “A decisão do STJ sobre os planos de stock options e a vinculação do Carf”, by DIANA PIATTI LOBO and Thais De Laurentiis. Published by Revista Consultor Jurídico (ConJur) (2024): https://bit.ly/40uLbLg

▶️ “Stock options: STJ define natureza mercantil dos planos de opção de compra de ações”, by Nathalia Oliveira and Jéssica Covolan. Published by JOTA (2024): https://bit.ly/40AU1Yc