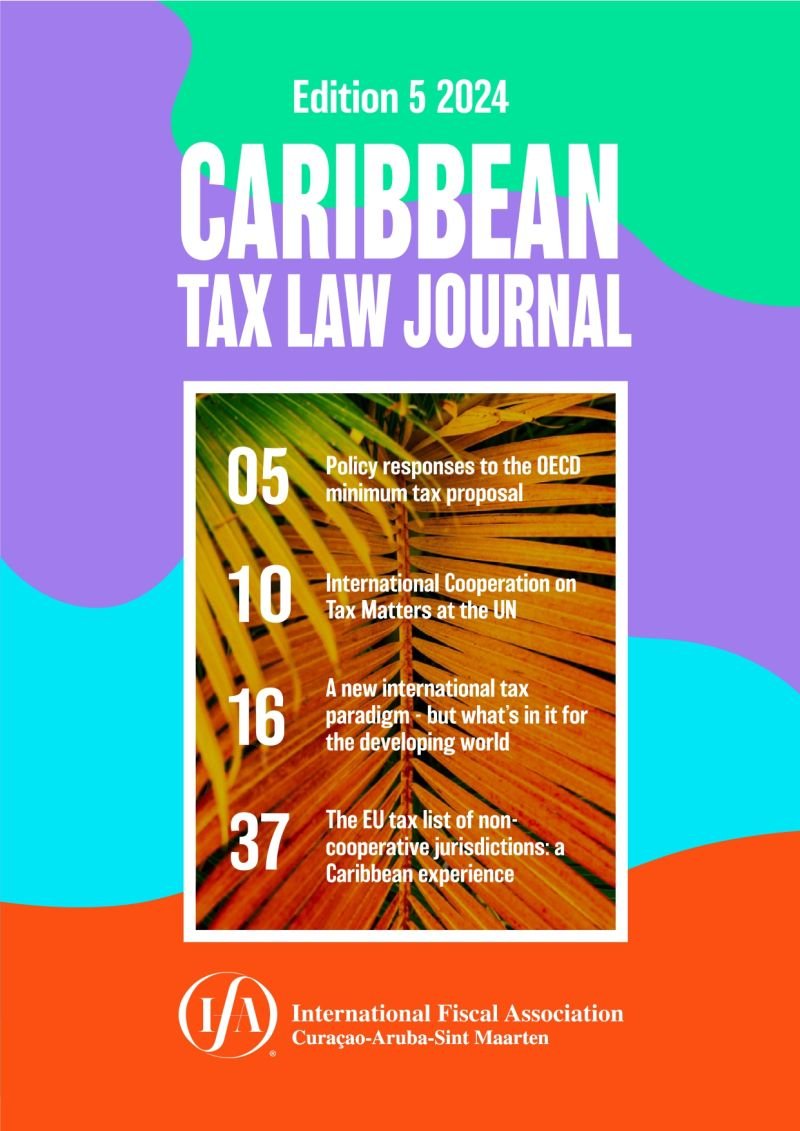

📚 The IFA Branch Curaçao-Aruba-Sint Maarten has recently released Edition 5 of their prestigious Caribbean Tax Law Journal. It features articles written by prominent tax experts across the globe. Here is the list of this Edition’s articles accompanied by other publications recommended as supplementary sources by the Latin American Tax Policy Forum (LATPF):

✅ “Policy responses to the OECD minimum tax proposal”, by Aitor Navarro. Available at: https://shorturl.at/cALWX

🔎 “Inviabilidade da implementação do Pilar 2 sob a ótica da igualdade tributária” (“Non-feasibility of the implementation of Pillar 2 in light of taxpayer equality”), by Thaís de Branco Valério. Published by Revista Consultor Jurídico (ConJur) and available in Portuguese at: https://shorturl.at/ao037

✅ “International Cooperation on Tax Matters at the UN”, by Leopoldo Parada. Available at: https://shorturl.at/ewHO7

🔎 “¿Puede la ONU liderar la fiscalidad internacional en detrimento de la OCDE?” (“Can the UN lead International Taxation to the detriment of the OECD?”), by Fernando Serrano Anton. Published by Legal Today and available in Spanish at: https://shorturl.at/ehlos

✅ “A new international tax paradigm – but what’s in it for the developing world”, by Svetislav Kostic. Available at: https://bit.ly/3SQAkpS

🔎 “El Impuesto Mínimo Global: del Acuerdo a la Implementación – Consideraciones de Política, Opciones de Puesta en Práctica y Próximos Pasos” (“The Global Minimum Tax: from Agreement to Implementation – Policy Considerations, Implementation Options and Next Steps”), by David O’Sullivan and Ana Cebreiro Gómez. Published by The World Bank and available in Spanish at: https://shorturl.at/uFNR4

✅ “The interaction between CFC rules and QDMTT: A Dutch Perspective”, by Tim van Brederode. Available at: https://bit.ly/42WXqjg

🔎 “Should CFC Regimes Grant a Tax Credit for Qualified Domestic Minimum Top-Up Taxes?”, by Heydon Wardell-Burrus. Published by Tax Notes and available at: https://bit.ly/3Thw2t3

✅ “The relevance of a QDMTT for Curaçao”, by Nayarid Sanchez. Available at: https://bit.ly/3Ioi8Py

🔎 “Pillar 2: QDMTT or Safe Harbour Domestic Minimum Top-Up Tax (SHDMTT)?”, by Joachim Englisch. Published by Wolters Kluwer International Tax Blog and available at: https://bit.ly/3uKfoZY

✅ “The EU tax list of non-cooperative jurisdictions: a Caribbean experience”, by Federica Casano. Available at: https://bit.ly/3IjkUpr

🔎 “The Ills of Blacklisting for International Taxation”, by Lucas de Lima Carvalho. Published by Wolters Kluwer International Tax Blog and available at: https://bit.ly/3SYZfb9

🔎 “El Salvador: La Política Tributaria e Impactos de los Paraísos Fiscales” (“El Salvador: Tax Policy and the Impact of Tax Havens”), by José Genaro Serrano. Published by Banco Central de Reserva and available in Spanish at: https://bit.ly/3Th7Oz9 🌎