💡 Can an employer deduct severance payments from the basis of its corporate income tax (CIT)?

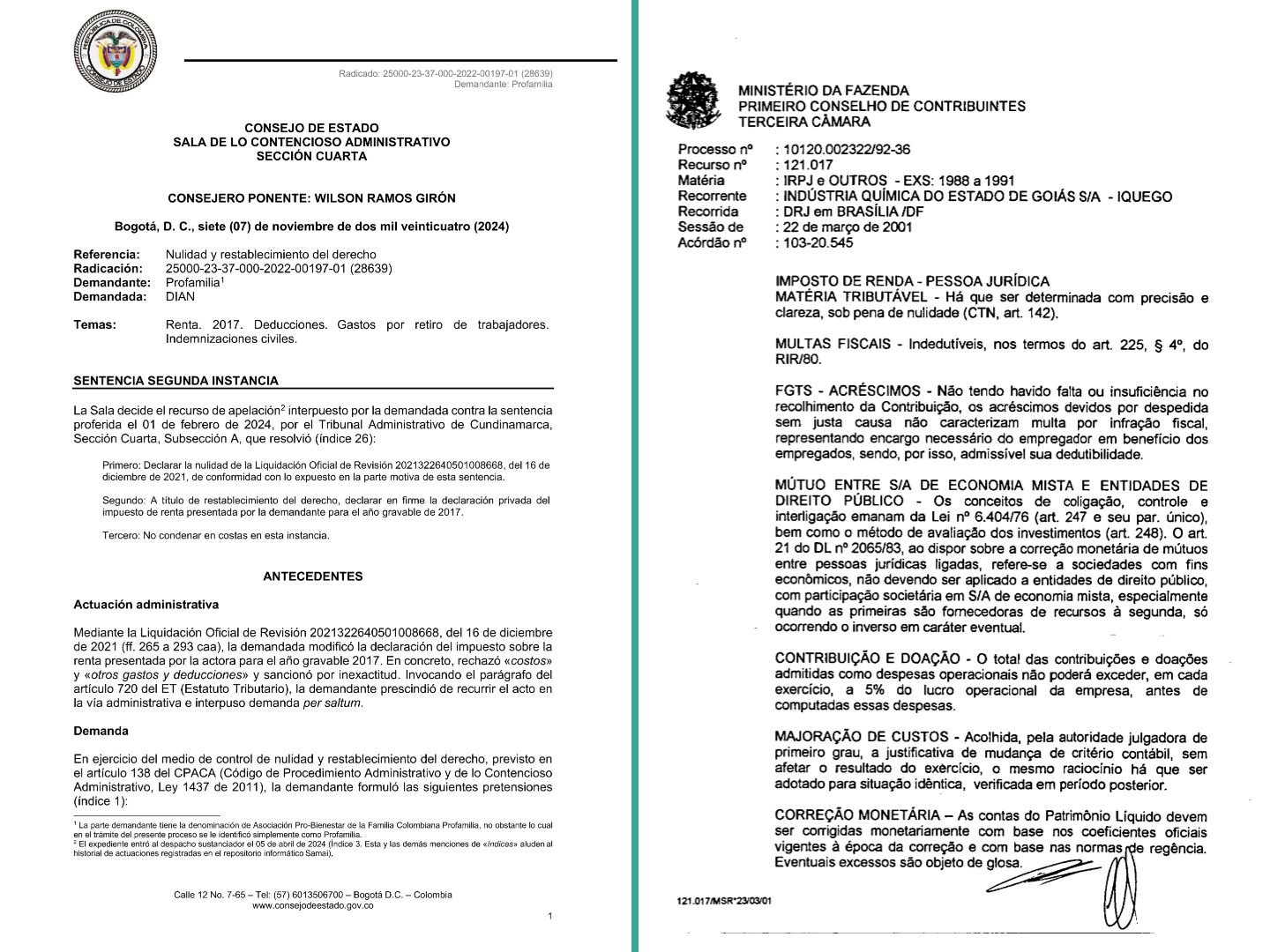

A recent decision (https://bit.ly/3Vb7x1h) issued by the Colombian Administrative Court (Consejo de Estado de Colombia) allowed an employer to deduct expenses incurred with the termination of employment agreements (i.e., indemnifying payments required by employment law in the event of a unilateral termination) because – and this is important – the employer proved that there was a “causal link” and a “necessary connection” (“causalidad y necesidad”) between those expenses and the maintenance of ongoing business operations (p. 8). Article 107 of the Colombian Tax Statute allows the deduction of general business expenses that meet these requirements.

What is fascinating about the ruling is that for some countries the mere fact that certain expenses are required to be paid by law (e.g., an indemnification that must be paid to an employee if the employer opts to terminate them without cause) is enough of a reason for them to be considered deductible – meaning, the employer (1) had to incur them as part of regular business operations and (2) not paying them would be either a contractual violation or a violation of applicable law. To drive home the point that Colombian Law takes a different approach, the (losing) argument of the tax authorities was that the employer would have had to prove a state of insolvency (p. 4) to only then be able to claim these termination-related expenses as deductible from the basis of CIT.

Compare this to an old decision issued by the former Conselho de Contribuintes in Brazil (currently CARF – Conselho Administrativo de Recursos Fiscais). In that case (https://bit.ly/3ZnH6Ii), the question analyzed by the administrative judges was whether additional – severance – payments of FGTS, a government-sponsored fund primarily used for housing/real estate purchases in Brazil, were deductible for CIT purposes. The answer was positive, but not because the employer proved that they were going through a period of financial distress. The court allowed the employer to deduct the expense because it represented “a worker’s right and an employer’s obligation” (p. 19), therefore meeting the threshold of “necessary business expense” (Art. 47 of Law 4,506/1964, still applicable today).

We would like to thank Juan Pablo Fernández López (for sharing the Colombian Consejo de Estado decision in a recent post available here – https://bit.ly/3B7haar) and Carlos Augusto Daniel Neto (for sharing the Brazilian CARF decision via DM).