Davi Santana de Jesus is a Transfer Pricing partner at CONSULTA Group. He is based in São Paulo (SP), Brazil.

As the opening whistle of the FIFA Club World Cup approaches, a new dynamic in Brazilian football becomes increasingly evident: the rise of Football Corporations (SAFs – Sociedades Anônimas do Futebol).

Mostly controlled by international investors, these entities aim to turn South American clubs into (a) well-managed football powerhouses chasing titles or into (b) talent incubators, with the goal of profiting from the sale of football players to the lucrative European market. Each reader is left to reflect on the true motivation of their favorite club.

While promising for the financial health of clubs, this strategy raises complex issues related to transfer pricing and the tax implications of international player transactions.

The cases of young Brazilian talents like Savinho (who has played in the Brazilian National Team) or Jeffinho, currently in Botafogo, with their transfers involving European clubs, serve as striking examples of the challenges and opportunities emerging in this scenario.

This article explores the latest tax implications and on-field impacts of this new era in global football.

The SAF landscape in Brazil

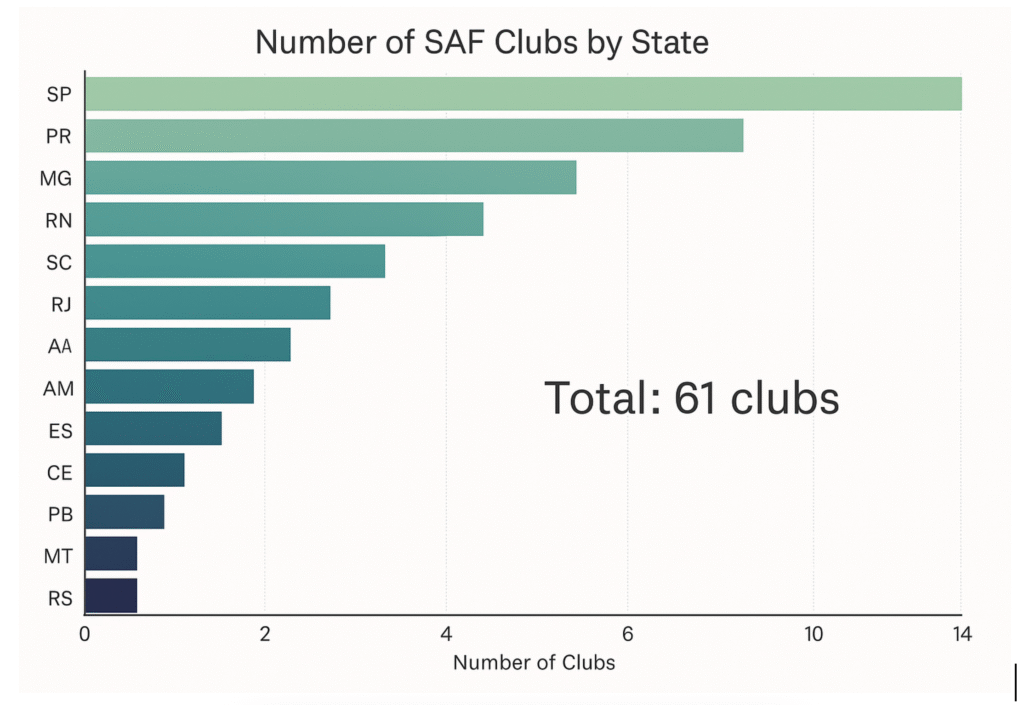

Law No. 14,193/21, known as the SAF Law, enacted in 2021, has sparked a major transformation in Brazilian football. Today, Brazil has over 60 clubs that have adopted this model, with the States of Minas Gerais, Paraná, and São Paulo leading the way.

The introduction of the SAF model in Brazil aims not only to promote financial sustainability and competitive sportsmanship but also to facilitate equity funding and foster the professional management of football clubs.

|

Club |

State |

Year of SAF |

Investor/Group |

|

Botafogo |

RJ |

2022 |

Eagle Football Holdings (John Textor) |

|

Cruzeiro |

MG |

2022 |

Pedro Lourenço (Supermercados BH) |

|

Vasco |

RJ |

2022 |

777 Partners (USA) |

|

Bahia |

BA |

2023 |

City Football Group (Manchester City) |

|

Coritiba |

PR |

2023 |

Treecorp (Brazil) |

|

América-MG |

MG |

2022 |

Independent SAF (mixed model, no majority external investor) |

There are many complex tax issues associated with the business of football, whether in Brazil, or South America, or other countries. The most complex among those issues is the taxation of cross-border transactions, meaning those that have a taxable nexus with more than one jurisdiction. This, coupled with the increasing consolidation of football clubs in the hands of controlling entities like Eagle Football Holdings and 777 Partners, gives rise to important (and not commonly explored) transfer pricing discussions.

Transfer Pricing in Football: The Arm’s Length Principle and Its Challenges

Transfer pricing refers to the pricing of goods, services, and intangible assets (such as football players) transferred between related entities within the same multinational group.

The fundamental principle governing transfer pricing is the arm’s length principle, which requires that transactions between related parties be conducted as if they took place between independent parties, under market conditions. The objective is to avoid profit shifting and tax evasion, ensuring that each jurisdiction taxes its fair share of the profit generated in its territory.

In football, applying the arm’s length principle is particularly challenging due to the unique nature of player valuation. A player’s value is not determined solely by on-field performance but also by subjective factors such as growth potential, age, injury history, marketing appeal, market demand, and even negotiation timing.

Moreover, player transfers often include complex clauses such as performance bonuses, resale percentages, and image rights, further complicating the determination of a fair market price.

The Savinho and Jeffinho Cases: Examples of Cross-Border Tax Impacts

The case of Brazilian player Savinho clearly illustrates the complexity of player transfers and their tax implications.

Savinho was acquired by Troyes, a second-division club of the French league, for approximately EUR 6.5 million in 2022. Interestingly, he never got to play for Troyes – he was loaned instead to PSV and then to Girona, a top-division Spanish club. After a breakout season at Girona, Manchester City – part of the same ownership group as Troyes and Girona (City Football Group, which also controls Bahia in Brazil) – purchased Savinho in 2024 for EUR 25 million.

This sequence of events raises several transfer pricing concerns:

• Profit level of Troyes: Troyes earned nearly EUR 20 million in profit from the sale of a player it never utilized. This could be interpreted as a reallocation of intragroup funds to shift profits to specific jurisdictions, potentially raising red flags for tax authorities.

- Market Value Discrepancy: According to Transfermarkt.com, Savinho’s market value at the time of his transfer to Manchester City was EUR 50 million. Yet the club paid only EUR 25 million. This EUR 25 million gap may imply that City recorded a lower expense, possibly aiding its compliance with Financial Fair Play (FFP) rules. An unrelated party likely would not have secured such a deal.

- Zero-Interest Loans: Player loans within the same group, especially without interest or under non-market terms, can also raise concerns. An independent club would typically expect compensation for lending a valuable asset.

Such examples show how intra-group transfers can directly affect the taxable profits in the countries involved, and tax authorities must monitor these transactions to ensure proper taxation in each jurisdiction.

Another illustrative case is that of Jeffinho, a young Brazilian forward developed by the football club of Resende-RJ. He was bought by Botafogo (owned by Eagle Football Group) in 2022 for EUR 300,000. In January 2023, he was sold to Lyon (also part of the Eagle Group) for an impressive EUR 10 million, despite his market value at the time being only EUR 1.5 million.

Shortly thereafter:

- He was loaned back to Botafogo for the 2023 and 2024 seasons;

- In January 2025, Botafogo re-purchased Jeffinho for EUR 5.3 million, at a market value of approximately EUR 5 million.

Although under contract with Lyon for four years, Jeffinho only played one season in France – spending almost the entire contract period in Brazil. Analyzing this through a transfer pricing lens highlights key red flags:

- Step 1 – Sale at a premium: Lyon bought Jeffinho for EUR 10 million in spite of his market valuation of just EUR 1.5 million – a premium of EUR 8.5 million.

- Step 2 – Transfer of exclusive use rights: Lyon loaned Jeffinho exclusively to Botafogo, with no clear disclosure of compensation, salary sharing, or valuation adjustment.

- Step 3 – Reacquisition at a loss: Botafogo re-acquired the player for EUR 5.3 million, generating a EUR 4.7 million loss for Lyon.

These transactions raise three major concerns:

- Inconsistent valuation of the intangible asset;

- Profit erosion in France through unexplained capital losses;

- Lack of transparency in documenting intercompany loans and transfers – impairing arm’s length justifications.

The Role of FIFA: Addressing Tax and Sports Fair Play

As the global governing body of football, FIFA plays a crucial role in promoting transparency and integrity in player transfers. Its initiative to use algorithms for calculating fair player transfer fees could serve as a significant step toward establishing objective benchmarking mechanisms.

Such a system would factor in elements like player performance, potential, marketability, and other key data to estimate a fair market value. Despite challenges – like club resistance and competition law issues – standardized valuations could create useful reference points for negotiations and assist tax authorities in enforcing arm’s length compliance.

Big Four firms (KPMG, Deloitte, EY, PwC) already maintain specialized transfer pricing teams, especially in Europe, that advise multinational companies – including football clubs – on navigating complex tax regulations. These teams could collaborate with FIFA and tax authorities in building robust methodologies for valuation and compliance in player transfers.

As shown in the cases of Savinho and Jeffinho, global SAF structures struggle to separate legitimate financial planning from strategic manipulation of value – both fiscally and competitively.

When Transfer Pricing Becomes an Off-Field Obstacle

What may begin as a fiscal planning tactic can lead to sporting damage – as in the case of Mexican club León and FIFA’s new Club World Cup regulations.

In 2024, León – despite winning the CONCACAF Champions League – was barred from the 2025 FIFA Club World Cup. Why? Because both León and Pachuca are owned by the same group (Grupo Pachuca).

FIFA regulations prohibit multiple clubs under the same ownership group from competing in the same edition of the tournament. This precedent could directly affect Brazilian clubs like Botafogo (Eagle Football Group) and Bahia (City Football Group), should they qualify for the Libertadores alongside their European ‘siblings’ Lyon and Manchester City.

The risk? A competitive blackout. As conglomerates expand in Brazil (Eagle, City, 777 Partners), we may soon see:

- Two or more Brazilian SAFs under the same group qualifying for national or continental competitions;

- International regulations barring them from participating in the same tournaments (Libertadores, Club World Cup, etc.).

This scenario not only violates the spirit of sporting fairness but also places external limits on the autonomy of Brazilian football – bound by group-level decisions driven more by tax and business logic than sport.

Conclusion

Just as transfer pricing aims to ensure that intercompany prices reflect market conditions, modern football must ensure that related-party decisions reflect competitive integrity.

Otherwise, what begins as a valuation or tax optimization strategy could result in star players excluded from global tournaments – or your club left out despite winning continental titles.

The new era of Brazilian football, driven by SAFs and internationalization, demands closer attention to transfer pricing. Player transfers within multinational groups can carry significant tax implications and must be analyzed carefully to uphold the arm’s length principle.

Collaboration between FIFA, CBF, tax authorities, and transfer pricing specialists is essential to establish guidelines that promote transparency, fiscal fairness, and integrity in the global football transfer market.

Because the future of football is not only played on the pitch – but also in the complex arenas of economics and international taxation.