🐴 “Trust arrives on foot and leaves on horseback.” (THORBECKE, Johan)

This is an image taken from a report titled “Public Trust in Tax 2024” (https://bit.ly/4aF7b9Z). It was produced by the OECD – OCDE in cooperation with IFAC and ACCA and it contains insights on public perceptions about taxation, as well as public trust in tax systems from 26 countries, primarily in LatAm, but also in Africa and Asia.

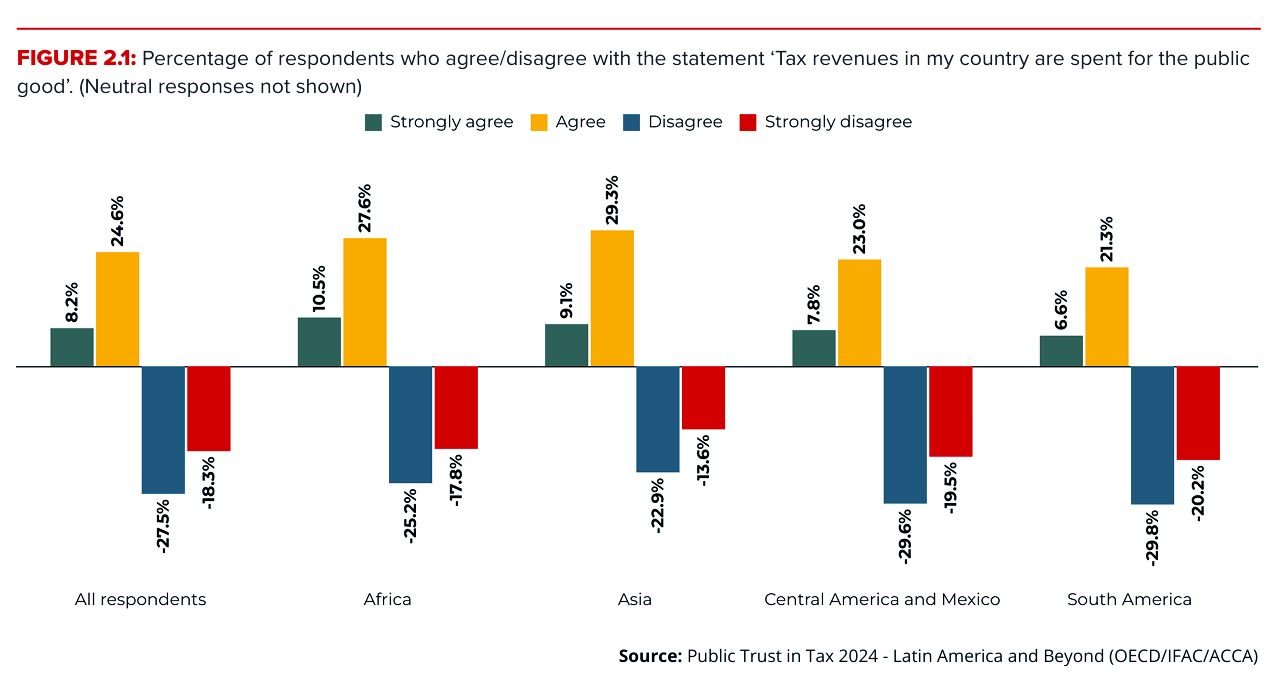

Public perception is a compelling litmus test for evaluating the effectiveness of tax policy design. While it reflects the legitimacy of taxpayer representation in the creation and application of tax laws, it can often be measured in concerning ways. If assessments hinge on concepts such as a “reasonable level of taxes paid” or the idea of “the public good” as the ultimate purpose of tax revenues, conclusions among respondents can vary widely.

Here are some interesting data points about LatAm countries highlighted in the report:

🔴 Respondents in LatAm countries have generally more negative views on their tax systems than their counterparts in Africa and Asia. (p. 5)

🟢 Around 45% of respondents in Brazil either distrust or highly distrust local tax authorities. In Bolivia, distrust or high distrust levels reach over 50%. (p. 27)

🔵 Over 20% of Chilean respondents believe that MNEs pay a reasonable amount of tax in Chile (p. 8 of the infogram – https://bit.ly/40ROaNY). There is likely a connection between this response and the notion of “fiscal sustainability” in Chile: a set of tax compliance standards that signal a level of cooperation between local companies and tax authorities, which disincentivizes tax evasion and avoidance practices.

✅ For further insight, we recommend an article titled “Advancing fiscal transparency in Latin American countries: new findings in reports on tax sustainability in Chile”, by Antonio Faúndez Ugalde, Patricia Toledo Zúñiga, Angela Toso and Francisco Saffie Gatica. Published in Sustainability Accounting, Management and Policy Journal, Volume 15, Issue 7 (2024). Available here: https://bit.ly/3EjZkTa